Months after Geraldine native Dustin Kittle publicly accused Alabama Farm Credit (AFC) of extortion and mishandling borrower's loans, the rural lender issued a statement to its customers denying all allegations of wrongdoing.

Now a former borrower, Kittle alleged AFC undervalued several of his properties to force him to include his mother's farm in Geraldine as additional collateral since his mortgaged properties were in Tennesee, outside of AFC's territory. When he tried to address the issue, Kittle said he was threatened with foreclosure on his properties despite never missing a payment.

In September, Kittle began posting documents, photos, texts and phone recordings to social media to support his claims that AFC violated federal lending laws. He has called a borrower meeting on December 29 in hopes of voting out the current board members and leadership.

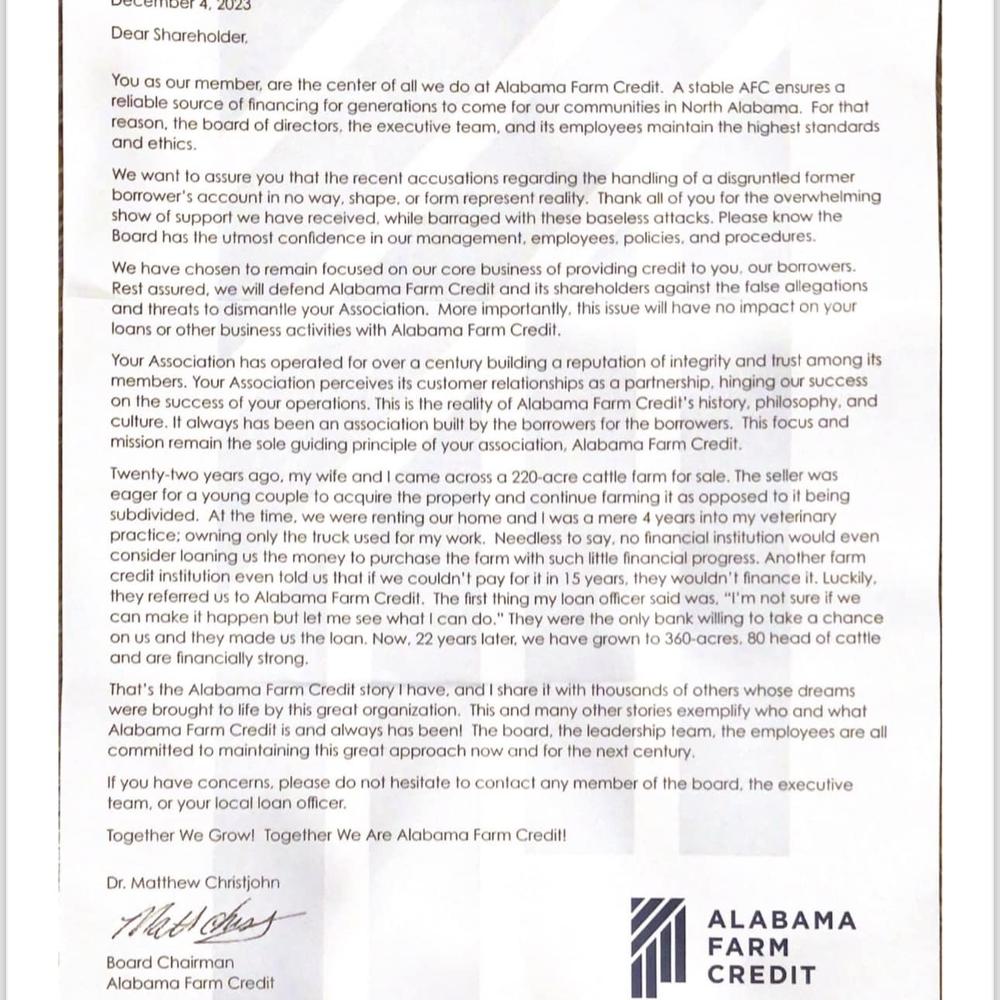

1819 News previously made several attempts to contact AFC and its lawyer about the accusations but never got a response. However, the lender finally broke its silence in a letter to borrowers dated December 4.

"We want to assure you that the recent accusations regarding the handling of a disgruntled former borrower's account in no way, shape, or form represent reality," the letter, signed by AFC board chairman Matthew Christjohn, stated. "Thank all of you for the overwhelming show of support we have received while barraged with these baseless attacks… We have chosen to remain focused on our core business of providing credit to you, our borrowers. Rest assured, we will defend Alabama Farm Credit and its shareholders against the false allegations and threats to dismantle your Association."

In a response posted to Facebook, Kittle said the AFC letter "bolstered" his claims rather than debunked them.

"It is about as embarrassing and as pathetic of an attempt to address what is unquestionably damning and overwhelming evidence as I have ever seen," he said in the post. "And also, it is insulting to everyone who is a current or former borrower who has dealt with the same type of improprieties that caused harm to us."

Kittle pointed out that the letter did not mention any specific allegation or the federal investigation into AFC that found wrongdoing based on his accusations.

Though Kittle has been the only former or current borrower to go public with his concerns with AFC, he said he's spoken to many people who have had similar issues.

"I was a customer from May' 13-April '20, and my farm ultimately ended up in foreclosure and bankruptcy," Justin Hosmer, a former borrower, told 1819 News. "The entire situation wasn't necessarily all to blame on Alabama Farm Credit as Tyson Foods was making a push to force out some of their older operations, but my lender was no helping hand in the matter. My issues with Alabama Farm Credit were with how they handled my money once it was directly deposited into a funds-held account. I lost all control of those funds, whether they were needed for loan payment purposes or not. I was forced to bring in paid invoices for farm-related expenses before I was able to get a refund of said expense from that account. It was my money, and the only access I had to it was in the form of reimbursements."

Another former borrower, Joey Norton, said he started having problems when Mel Koller took over as AFC president and CEO in 2018.

"The moment Mel took over, it went south," he said. "They were refinancing everyone's loans when the interest rates dropped. They refused to look at mine because I was friends with Heath Davis. He couldn't stand Heath because Heath applied for his job. I eventually refinanced with Citizens Bank and Trust."

Former borrower Jordan Johnson said, "They called our loan with no legal reason… It was total hell with them for about six months."

Johnson claimed AFC also withheld some of his profits from his poultry operation and threatened him with foreclosure when he complained.

SEE ALSO: Borrower alleges more 'improprieties' at Alabama Farm Credit involving poultry' lender theft'

"We were on a sixflock mortgage; two payments per year," he explained. "In 365 days, we had two years with seven, one pushing eight. They did not give us access to the extra funds; they applied it to the principal without our permission, and it nearly bankrupted us."

He continued, "It was shortly after we confronted them about our problem with the funds held policy we received a distressed loan letter and foreclosure paperwork. We were current on our loan and had never missed a payment, but that didn't stop them. We put the farm for sale and thankfully closed on the sale the day the closing attorney was filing the foreclosure paperwork."

One current borrower spoke to 1819 News on the condition of anonymity. The borrower recounted similar issues with AFC before closing his first loan. The borrower said when he went to apply for a loan for a poultry farm, his request for an appraisal was repeatedly delayed, during which time no one at AFC would provide any help or answers as mortgage rates kept climbing.

"When finally everything was approved, and I did get my home sold, they failed to send paperwork in," the borrower said. "It was an additional month and a half before I got FDA approval. They cost me a lot of money on the front end."

Since finalizing his mortgage, the borrower said he has faced repeated communication issues and has struggled to answer basic questions about his loan.

A former employee who worked as a branch manager for over 20 years told 1819 News that these issues began after Keller and the new management team took over.

The anonymous former employee said Koller wrongfully fired him for how he handled an incident with an employee two years prior. He was offered six months' pay in exchange for signing a non-disclosure agreement. He said NDAs were common for employees and former employees and that AFC used their lawyers to "bully people."

"Basically what happened, the philosophy of Farm Credit changed," he said. "Farm Credit was initially set up for farmers who didn't qualify for the typical loans at banks… You have to have a true relationship with your borrowers. The new management came in, and they want to treat Farm Credit; they want it to be Bank of America or Regions Bank or whatever. They want to make a loan, put it in a filing cabinet, and they never have to talk to you again… It's just basically a fundamental shift in philosophy from what Farm Credit was established to be."

The former employee said he doesn't doubt Kittle's claims, though he never saw any of the alleged behavior firsthand.

"I don't know that they've done anything strictly illegal, but I know they've probably pushed the envelope at every opportunity," he said.

With thousands of voting stockholders, he said he knew the issues were most likely widespread but believed people were too afraid of retaliation to complain.

"The fear is what is keeping everybody from speaking out, especially the borrowers," he said. "I think the borrowers would be up in arms, but they see what's happened to Dustin, they see what's happened to a couple of other folks out there, and they're afraid, 'Hey, if I'm the only one to stick my head out, I'm getting it chopped off.' And from what I've seen, I don't doubt it."

To connect with the story's author or comment, email daniel.taylor@1819news.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.