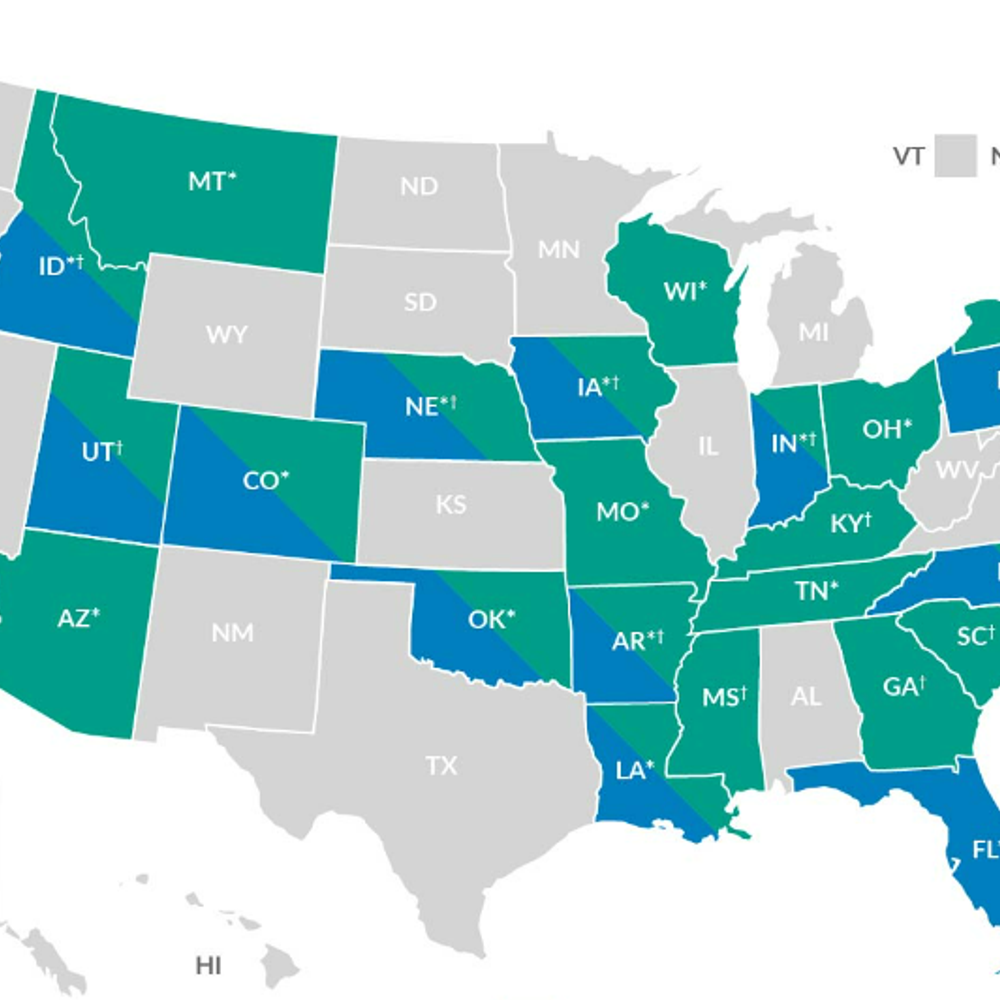

Alabama was the only state in the Southeast to not offer its citizens any broad-based, major sales or income tax relief in 2021 or 2022.

According to the Tax Foundation, every state in the Southeast United States except Alabama implemented or enacted some type of state sales or personal/corporate income tax relief within the past two calendar years.

“You’re right that Alabama stands out as an island in the Southeast in terms of tax reform in the past two years,” Janelle Fritts, Tax Foundation’s state policy analyst, told 1819 News. “Alabama could consider a number of changes to become more competitive among states.”

A spokeswoman for Gov. Kay Ivey didn’t return a request for comment.

Alabama has passed some smaller, targeted tax relief measures in recent years despite not passing any major, broad-based sales or income tax relief in 2021 or 2022. In May, Ivey signed into law a bill that phases out the business privilege tax for Alabama small businesses in 2024. Ivey also signed a bill passed by Alabama legislators that would exempt $6,000 of taxable retirement income for taxpayers aged 65 and older.

Fritts said that “Alabama’s sales tax is the first thing that stands out” when it comes to looking at Alabama’s overall tax structure.

“Unlike most states, Alabama allows localities to collect their own sales taxes, which complicates compliance for out-of-state businesses, or even in-state businesses that sell to multiple jurisdictions,” Fritts said. “Additionally, Alabama has very high state and local sales taxes. If the state expanded its sales tax base to include services, it could bring down the rate and help stabilize revenues—or use the extra revenue for income tax rate relief.”

According to the Tax Foundation, Alabama has the fifth-highest combined state and average local sales tax rate in the country at 9.24%. Alabama’s top individual income tax rate is 5%. Alabama’s neighbors, Florida and Tennessee, don’t have an individual income tax. Georgia’s top individual income tax rate is higher than Alabama’s, currently at 5.75%, but that could drop to 4.99% in 2029 under a new law there that went into effect in April. Mississippi passed a law in April that would gradually implement a 4% flat income tax by 2026.

Regarding Alabama's income tax, Fritts said an "easier change that would help the state's competitiveness would be to consolidate the state's three income tax brackets into one flat rate."

"The current threshold for the top rate is very low—only $3,000—so almost everyone in the state is already subject to it," Fritts explained. "A true flat rate would provide a buffer against inflation, protect against rate increases in the future, and make it easier for the state to estimate revenue impacts of future tax reforms."

State Sen. Arthur Orr (R-Decatur), the Senate Education Trust Fund chairman, has floated the possibility of lawmakers offering a tax rebate next year, given the current budget surplus.

"So, a rebate, seems to me, is very targeted," Orr said in an interview with Mobile radio FM Talk 106.5's "The Jeff Poor Show" in August. "We know the amount we're dealing with, and it needs to be substantial. You see what other states are doing. We've got reports on other states on how they've conducted a rebate program. We need to be part of that here in Alabama, in addition to looking at additional tax cuts that make sense going forward to help the people in the state long term by putting the money back in people's hands and let them spend it how they will, not make that decision in Montgomery, spending it on more government."

Alabama's budget surplus was $1.5 billion in 2021. The surplus amount for 2022 is currently unknown but is expected to be "at least" $1 billion higher than last year, according to Justin Bogie, senior director of Fiscal Policy at the Alabama Policy Institute (API).

API endorses reducing taxes by $750 million over three years, repealing the state's sales tax on groceries, and reducing the corporate income tax to 4.75%.

To connect with the author of this story, or to comment, email caleb.taylor@1819News.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.