I wasn't supposed to see it. Or hear it.

But I couldn't tear my five-year-old eyes away.

My dad, a UAB internal medicine resident, was moonlighting. Occasionally, my brother and I tagged along, with the express understanding that we would stay in the tiny call room no matter what.

Except for the time that I didn't. That time, around midnight, I stood outside the double doors of an ER bay, watching my dad pressing on a man's chest over and over and over.

I was confused and didn't understand what was happening. What's more, I couldn't unsee it, and the image still haunts me today … much like our modern health care system.

It's hard to unsee the cancerous mass the health care system has become. Covid was diagnostic, especially after Big Pharma begged us to trust them while covering up freak elements tucked inside their untested vaccine.

But beyond that, health care – big pharma, big hospitals, big government, big insurance and doctors – has mushroomed into a complex puzzle where no one gets blamed if things never get fixed. Which has piqued my interest about Big Insurance and an offshoot of Big Pharma called Pharmacy Benefit Managers.

Let's start with health insurance.

Imagine that a middleman stepped in and set a professional fee schedule for your business, no questions asked.

Never mind how much it costs you. Never mind the arbitrary rules you must follow, or the excess hours you spend because of federal regulations requiring detailed reporting. Never mind the expensive cyber insurance you must now carry because of federal dictates regarding electronic health records. And never mind how much your overhead expenses balloon.

That doesn’t matter. Intermediaries decide your fate. And they don’t care about any of that.

This isn’t about money. This is about what life is like for your doctor – who, by the way, expects none of your sympathy.

It’s also about being told what you’re worth by a Blue Cross, C-suite executive down the street, who, by the way, won’t allow doctors to gather and talk about the professional schedule they set. Doing so means doctors face lawsuits for collusion.

To be sure, C-Suite middlemen graciously allow "society" gatherings based on a doctor's specialty. A Cardiology Society, or an Orthopedic Society.

But that society holds no weight. It's worthless – it can't make any changes. It can't fight back. Yet on and on and on it goes for Alabama's physicians, men and women stranded in a loop of cost and inefficiency.

And then there's the nationwide group called pharmacy benefit managers, or PBMs. That sounds like a Marxist idea – give something a sweet name and then do the opposite.

The first PBM was founded in 1968 with the arrival of the plastic benefit card. Soon after, PBMs became the middlemen who negotiated prescription drug claims. Wikipedia defines a PBM as “a third-party administrator of prescription drug programs for commercial health plans, self-insured employer plans, Medicare Part D plans, the Federal Employees Health Benefits Program, and state government employee plans.”

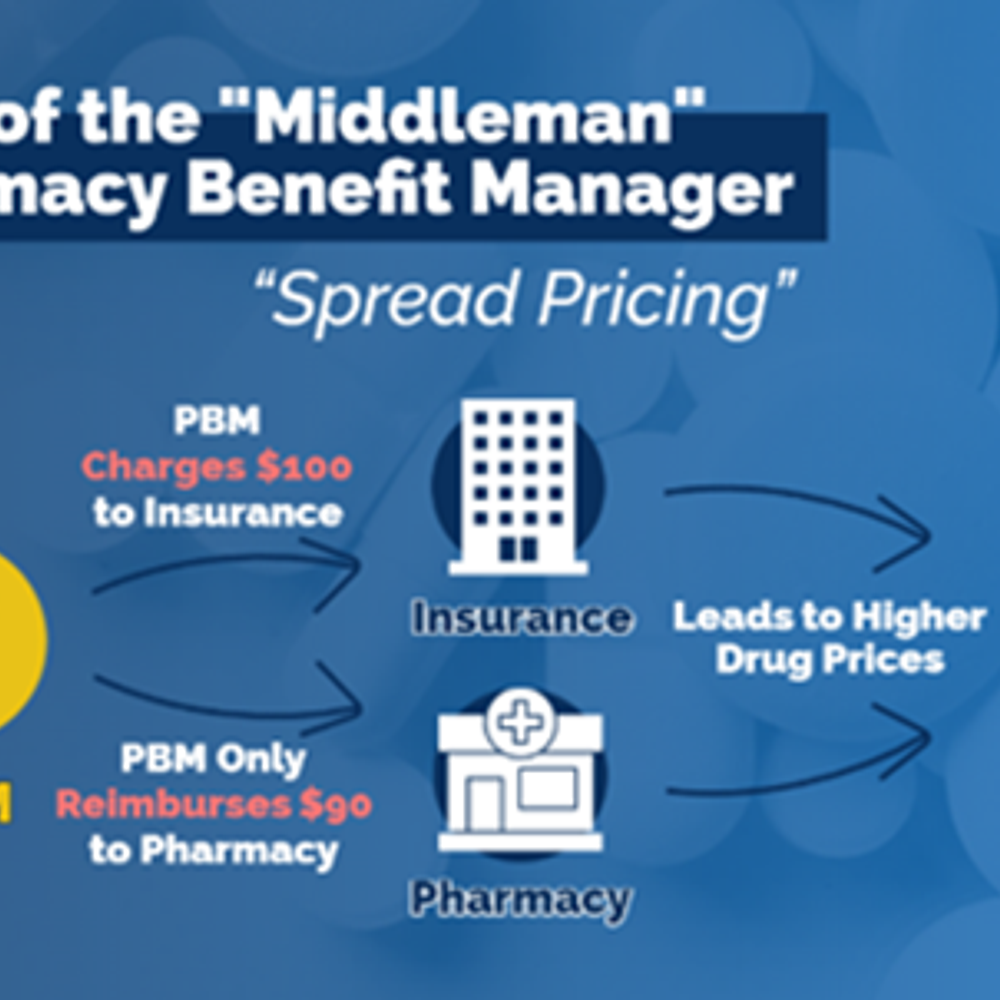

That means that instead of pharmacies negotiating the best price directly from pharmaceutical companies for a particular drug, PBMs are in the middle, fixing drug prices and pocketing the difference.

It's a federally mandated scam.

The good news is that PBMs have come under significant scrutiny.

"Other sectors of health care are alarmed by the power of the PBMs and are appealing to the Biden administration and Congress to rein them in,” NPR wrote earlier this year. “Drugmakers are especially up in arms … but employers, pharmacies, doctors, and even patients chafe at PBM practices like ‘spread pricing,’ in which the companies pocket money negotiated on behalf of health plans.”

We can’t unsee that health care is a mess.

But it doesn't have to be that way.

Wouldn’t it be nice to operate inside of a free market system instead? We can offload health care's third-party freeloaders and dramatically cut costs. We can let the market decide what those costs should be. We can require transparency in medicine with prices, drugs, and doctor visits. And while we're at it, we can also get someone to finally explain why a Tylenol caplet costs $550 if you go to the ER.

One final question:

While Blue Cross and other health insurers negotiate the silence of doctors, and while pharmacy benefit managers confer in a hideously communistic fashion to fix pharmaceutical prices and pocket the difference, shouldn’t health care’s middlemen get out of the way so that we can negotiate for us?

Amie Beth Shaver is a speaker, writer and media commentator. Her column appears every Wednesday in 1819 News. Shaver served on the Alabama GOP State Executive Committee, was a candidate for State House District 43 and spokeswoman for Allied Women.

The views and opinions expressed here are those of the author and do not necessarily reflect the policy or position of 1819 News. To comment, please send an email with your name and contact information to Commentary@1819News.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.