Spring is typically primetime for homebuyers, but even with plenty of homes for sale, Alabama is experiencing one of the slowest markets since the 1990s with little hope of improvement soon.

February 2024 saw the highest inventory for that month since 2020, with 1.07 million unsold homes on the market.

At the same time, buyers were more encouraged, according to numbers provided by the National Association of Realtors (NAR). Sales of previously owned homes increased by 9.5% with a seasonally adjusted rate of 4.38 million units. That is an increase from January but a 3.3% decrease from February 2023.

The median price of those units was $384,500, the highest median price for February since 1999.

Jeremy Walker, the CEO of the Alabama Association of Realtors, said the housing market's health depends on hyper-local numbers. He said that one city can be booming while a city 30 miles away can be in a rut.

"I think realtors on the ground may see different things in different markets," Walker told 1819 News. "You know, real estate tends to be hyper-local."

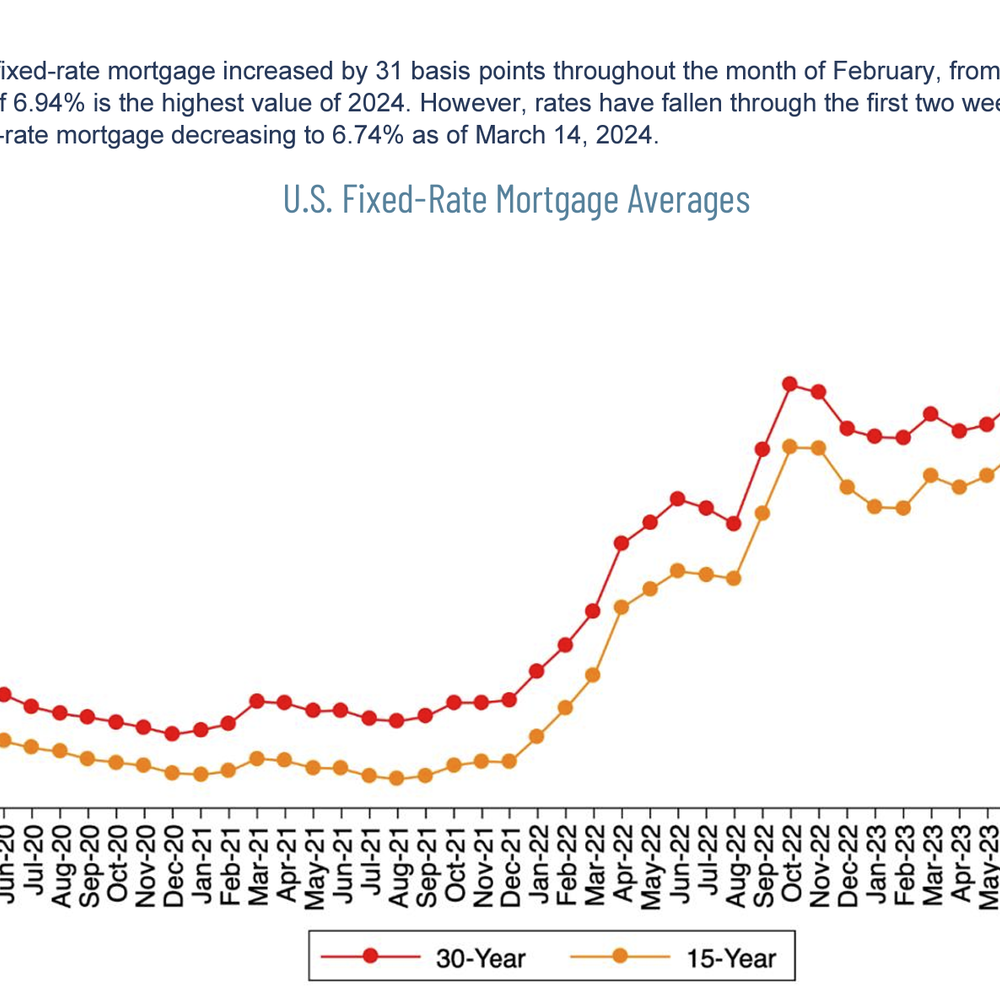

Overall, Walker said Alabama's market is still tough, and there are challenges for both buyers and sellers. He said the glaring issue is high interest rates, and he doesn't think that will change anytime soon.

With 85% of mortgage holders in Alabama having a rate below 6%, Walker says it is less likely for those people to sell their homes and have to buy another one at a higher rate.

"So, you've got people that are sitting on the sidelines waiting for there to be some type of break in interest rates before they consider changing houses," he said.

Another issue buyers are facing is the supply issue. While there is improvement in the number of listings, there is still not an ample, affordable supply.

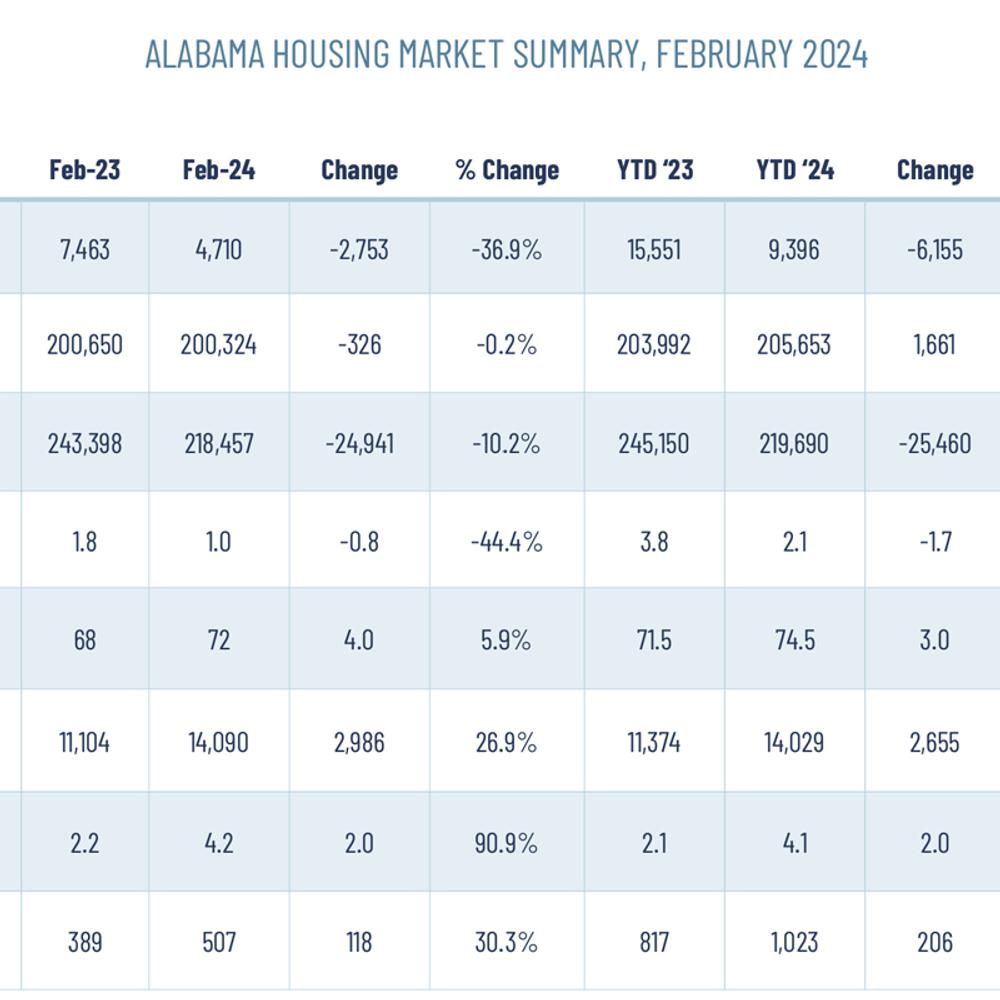

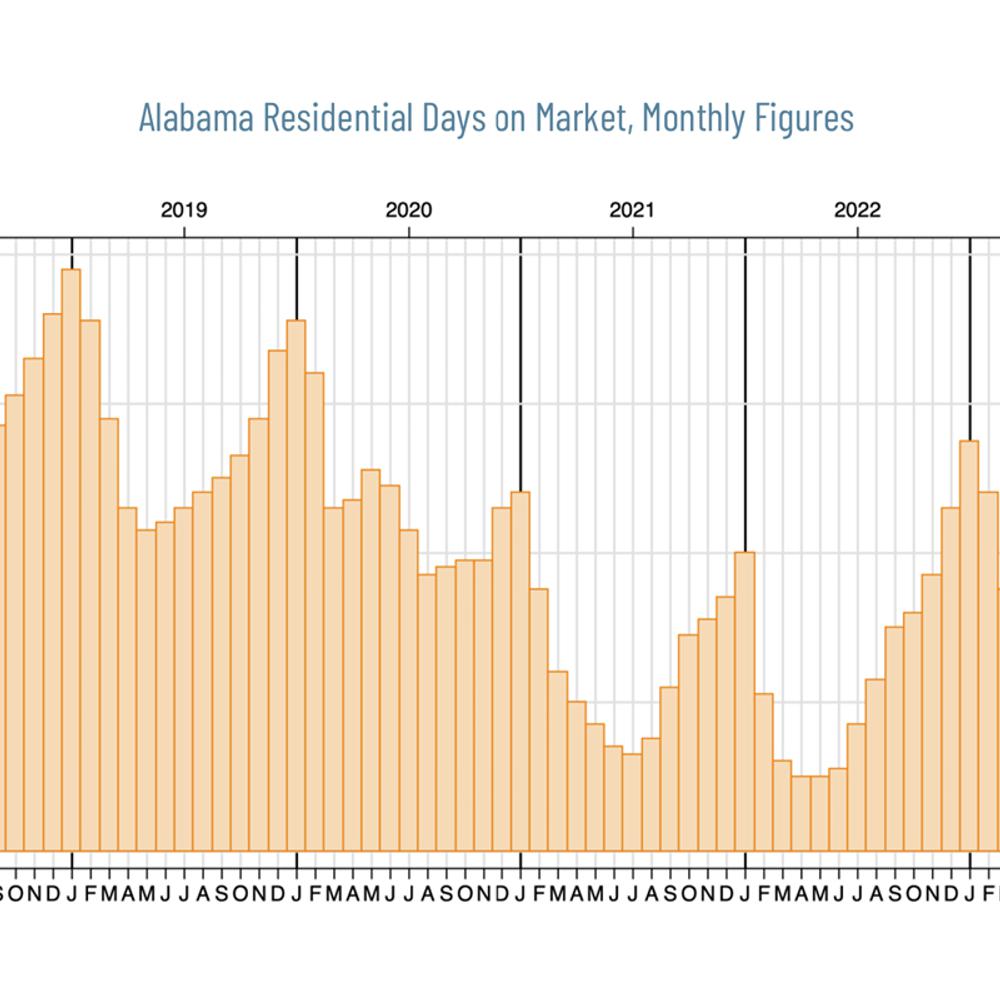

Numbers show there hasn't been much change in how long homes stay on the market. Homes sold in February 2024 were on the market for 72 days, on average. That figure is only five days longer than February 2023.

Walker said the most robust markets are in Baldwin, Lee, Madison, Shelby and Tuscaloosa Counties.

"I think you see very strong, steady increases in home values in those places," Walker explained. "You know, and I think if something comes on the market, it's traditionally not, you know not there for long."

"I think you see a lot of multiple offer situations," he added.

Walker said a little help is coming from people moving to Alabama from out of state. He said the low cost of living is often a driver for buyers and can help them justify paying more and having a higher interest rate on their home.

"They can feel pretty good about that investment increasing over time," he said. "And if you're a seller, you know, you've got to feel good pretty about that as well."

Walker said Alabama is still a dip in home sales not seen since the 1990s. Those numbers peaked in 2021 and have been on a decline since.

"It's a very slow period by historical standards, even by recent standards," Walker explained. "There's a lot of conflicting numbers and I think if you talk to any economist, most of them will tell you there is conflicting data in the economy, and particularly in housing markets."

Walker said there has also been a drop in home values due to supply and demand, but it is good news regarding people avoiding foreclosure.

"Home sales have slowed, again, because of interest rates and the rate lock, but people are not losing their homes," he added.

See the report:

February 2024 Monthly Report by Erica Thomas on Scribd

To connect with the author of this story or to comment, email erica.thomas@1819news.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning or become a member to gain access to exclusive content and 1819 News merch.