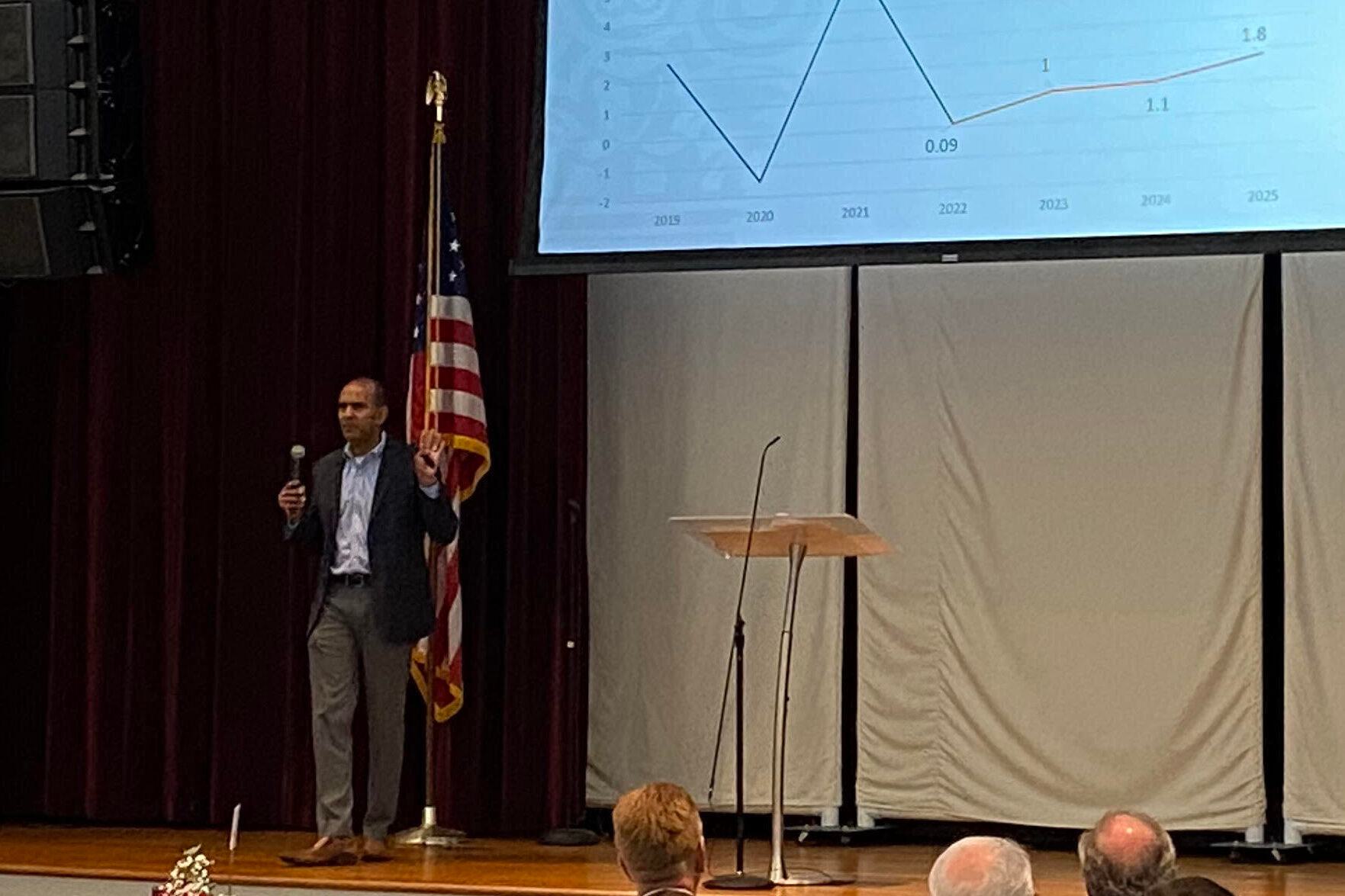

DOTHAN — On Tuesday, Anoop Mishra of the Atlanta Federal Reserve Bank delivered remarks to the Dothan Chamber of Commerce at their State of the Economy Luncheon. Mishra said his goal was to “distill how we at the Fed are thinking about the economy, how we are trying to make sense of what are really a lot of competing anecdotes, competing data that portrays a really muddled picture of the economy.”

Mishra said many in business hold conflicting opinions about the economy, as do many consumers, with views ranging from recession to an economic boom.

“For everybody that I talk to who says, ‘Hey, we’re seeing softening in the economy,’ there are other folks I talk to who say record year. For everyone that says, ‘We think consumer spending is slowing down,’ somebody else is saying, ‘No, listen, the consumer is still going strong.’”

Despite widespread cynicism about the American market, Mishra pointed out that, based on GDP numbers, the U.S. is not in a recession. “Typically, when you talk about the technical definition of a recession, what you see is two consecutive quarters of negative GDP growth, and we’re just not there,” Mishra said. “Look what’s happened in Q4 of last year and even Q1 of this year. It’s been positive growth. It’s been modest, but it’s been positive growth.”

According to Mishra, this unexpected GDP growth “has been driven by the consumer,” adding, “We’ve been resilient because the consumer is resilient.”

This continued spending is due in large part to increased savings during the pandemic, where consumer savings "went from eight percent pre-pandemic to thirty percent during." The total savings at one point totaled $2 trillion, now down to $400 million. These savings have allowed Americans to spend more than they otherwise could, resulting in continued GDP growth despite some signs of a slowing economy.

"That is what is tempering what could be a much more difficult economic situation and still creating some positive growth," Mishra said.

However, he pointed out that this is not universal. The vast majority of the remaining $400 million is largely concentrated within "the top 20% of income earners." "Much of our working population has been in a recession for the last year," he added.

Most of this spending by the top 20% is largely in the service sector, resulting in a split economy where some businesses are seeing sales and growth while others are stagnating or declining.

To connect with the author of this story or to comment, email gnicktreglia@gmail.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.