Account

Loading...

Earlier this week, Lt. Gov. Will Ainsworth publicly announced his opposition to a bill that would change the makeup of the State Board of Veterans Affairs and how the Alabama Department of Veterans Affairs (ADVA) commissioner is appointed.

At a time when congressional politics remain so deeply partisan and polarized, Katie Britt’s assemblage of bi-partisan support for a bill that so many on the far left find distasteful is a remarkable feat and a testament to her skills, talents, and, quite frankly, her personal charm.

Legislation passed in the 2024 session that provides a state income tax exemption for active duty pay for National Guard members and reservists became law on Wednesday.

A “legislative fix” might be needed to a 2023 grocery tax cut law after the city of Hoover said on Tuesday they weren’t implementing a planned local grocery tax cut due to state restrictions, according to State Sen. Andrew Jones (R-Centre).

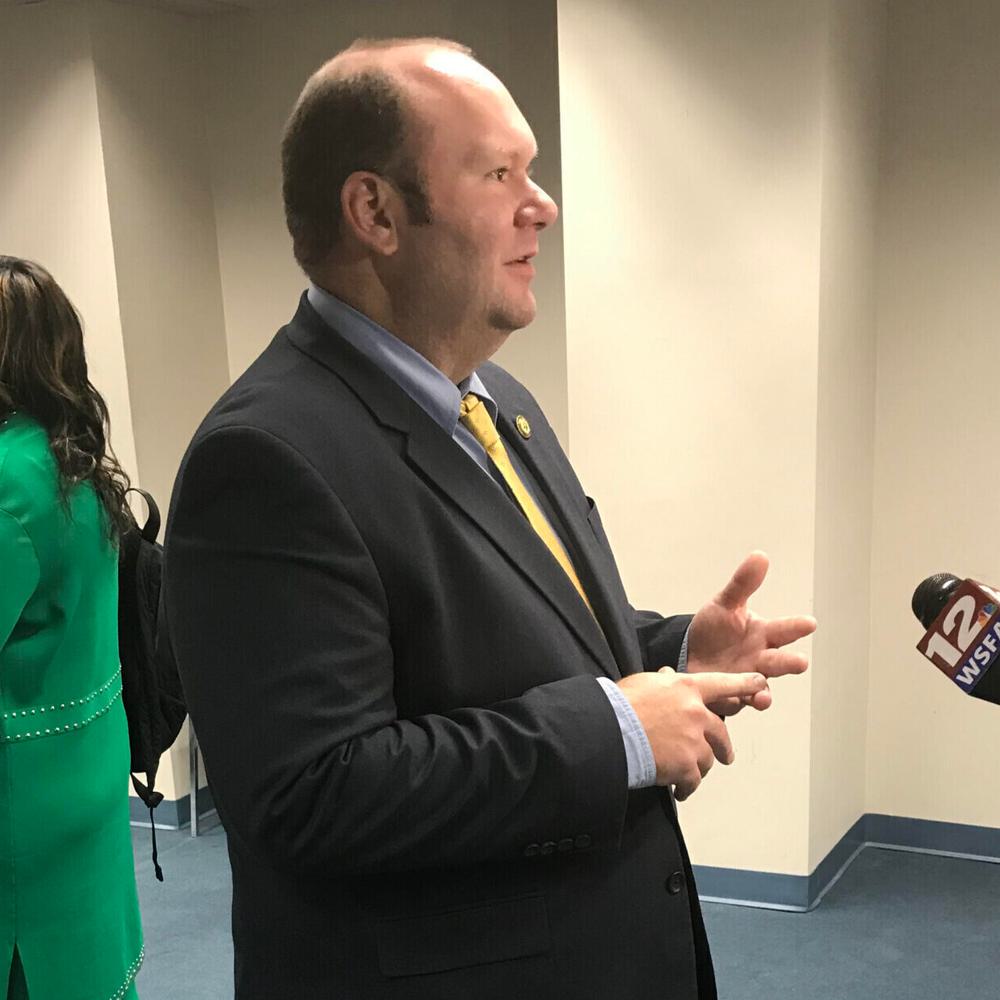

State Sen. Andrew Jones (R-Centre) is carrying legislation that would assist veterans suffering from the many mental health issues associated with military service who lack treatment from the U.S. Department of Veterans Affairs.

Members of the Senate Fiscal Responsibility and Economic Development will consider legislation on Wednesday allowing the Office of State Auditor to attempt to recoup negligent loss or theft of state property.

The Alabama Senate passed legislation on Tuesday that provides a state income tax exemption for active duty pay for National Guard and Reservists.

Comprehensive gambling legislation sailed through the House last week, but the Senate isn’t in a rush yet to advance the proposals.

Alabama shoppers won’t be seeing a second penny cut from the grocery tax in 2024.

State and local officials have begun planning a possible Sweet Trails Alabama system that would eventually connect all 67 counties.

Members of the Joint Study Commission on Grocery Taxation met on Tuesday for their first meeting of the quadrennium to begin considering the feasibility of eliminating the state’s sales tax on groceries.

Gov. Kay Ivey signed grocery tax cut legislation passed during the final days of the legislative session into law on Thursday.

The Senate unanimously passed amended legislation that would cut the state's sales tax on groceries by 2% on Thursday.

Members of the Senate Education Budget Committee passed legislation that would cut the state's sales tax on groceries by 2% on Wednesday.

The Alabama House and Senate passed a joint resolution on Thursday forming a commission to study possible elimination of the state’s sales tax on groceries.

A new grocery tax cut proposal by State Sen. Andrew Jones (R-Centre) was introduced late last week with the entire Senate signed on as co-sponsors.

State Sen. Andrew Jones (R-Centre) filed legislation Thursday that would cut the state’s sales tax on groceries in half over time.

The approved amendment would delay application of the 1% cap for cities with outstanding debt secured by occupational taxes until the January after the final payment on the debt is made.

State Sen. Andrew Jones (R-Centre) filed legislation that would reduce existing local occupational taxes incrementally down to 1% and exempt some employees from the tax.

While some state officials argue for tax cuts in light of Alabama’s $2.7 billion budget surplus, State Sen. Andrew Jones is look for relief elsewhere by eliminating occupational taxes.

Occupational taxes are local taxes businesses and service providers pay to operate within a municipality. For Gadsden, they account for nearly 30% of the annual budget — roughly $15 million.

Alabama was one of the only southeastern states in 2021 and 2022 to not offer its citizens any major, broad-based sales or income tax relief despite large state budget surpluses recently.

Many Alabamians may soon find some financial relief if State Sen. Andrew Jones' (R-Centre) bill to reduce municipal occupational taxes makes it through the Legislature next session.

The Alabama Policy Institute (API) announced it supports a bill repealing the tax on groceries. API added the bill to its annual legislative...

Proposed legislation that would gradually phase out municipal occupation taxes stalled in committee earlier this week with legislators...

Legislation has been pre-filed for an amendment to the Alabama Constitution of 1901 that would abolish the office of State Auditor....

By Brandon Moseley The Alabama Forestry Association (AFA) on Monday announced its endorsement of Republican State Sen. Andrew Jones...