State Sen. Andrew Jones' (R-Centre) bill to reduce occupational taxes statewide has advanced out of committee after being approved with a substitution and one amendment.

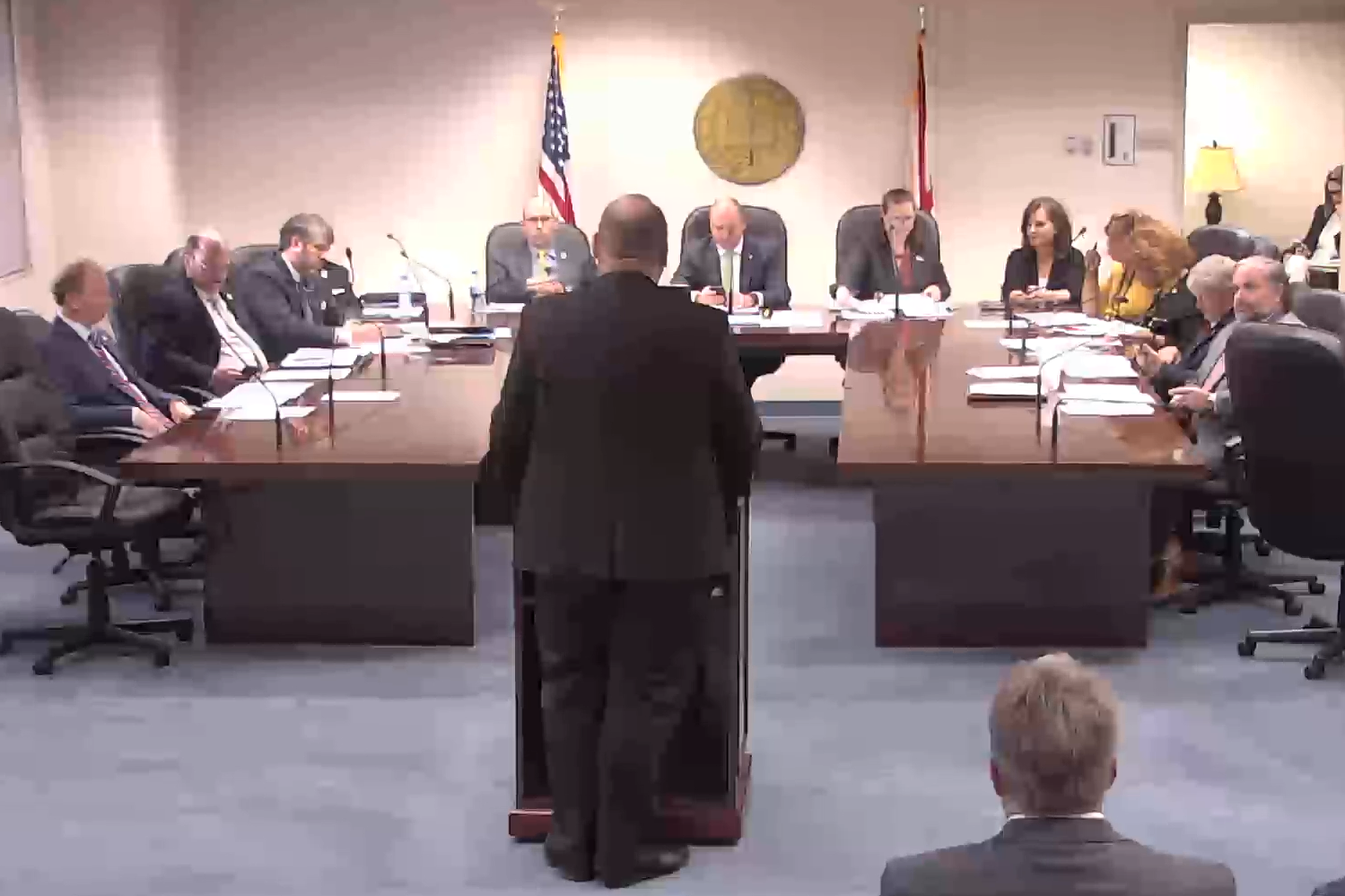

Jones presented SB65 to the Senate County and Municipal Government Committee on Tuesday. The bill would place a 1% cap on occupational license fees and prevent municipalities from creating new ones. The substitution changed how the bill deals with property annexation.

"The previous bill said that you couldn't apply occupation taxes to anything annexed after January 1 of this year," Jones told the committee. "We've compromised and worked on that to address some concerns, and it now says you can't apply it to 1,000-acre sites annexed after January 1."

The approved amendment would delay the application of the 1% cap for cities with outstanding debt secured by occupational taxes until the January after the final payment on the debt is made.

"Those of you who were concerned about loss of revenue, they've got more than enough time now with this amendment to know its coming," Jones said.

Several Alabama mayors and city officials spoke in opposition to the bill calling it a governmental overreach that would negatively impact their budgets and force them to cut city services significantly.

State Sen. Merika Coleman (D-Pleasant Grove) proposed an amendment to exempt Birmingham, Attalla, Gadsden, Tuskegee, Troy, Guin, Fairfield, Bessemer and Soligent from the bill.

State Sen. Linda Coleman-Madison (D-Birmingham) proposed an amendment for the bill not to apply to class 1 municipalities.

Both amendments failed to pass.

"I think there's a lot of things in this bill that we can agree on," Jones said. "For example, can we all agree that when people lose their job as part of a plant closure as they did at Goodyear, they shouldn't have 2% of their supplemental unemployment severance pay taxed? Can we agree that if you're employed by a company, and you don't even work at headquarters, part of the week you work at home, can we not all agree that you shouldn't have your wages taxed as if you have been working in the city for the entire time? Can we not agree that first responders … coming in for mutual aid, they shouldn't have had to 2% … of their salaries taken out when they came to the aid of their fellow man in Alabama?"

The committee approved the bill, 5-4, and it will now go to the Senate floor for debate.

To connect with the author of this story or to comment, email daniel.taylor@1819news.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.