Account

Loading...

Gov. Kay Ivey has signed legislation into law that caps the amount property tax can increase every year after reappraisals.

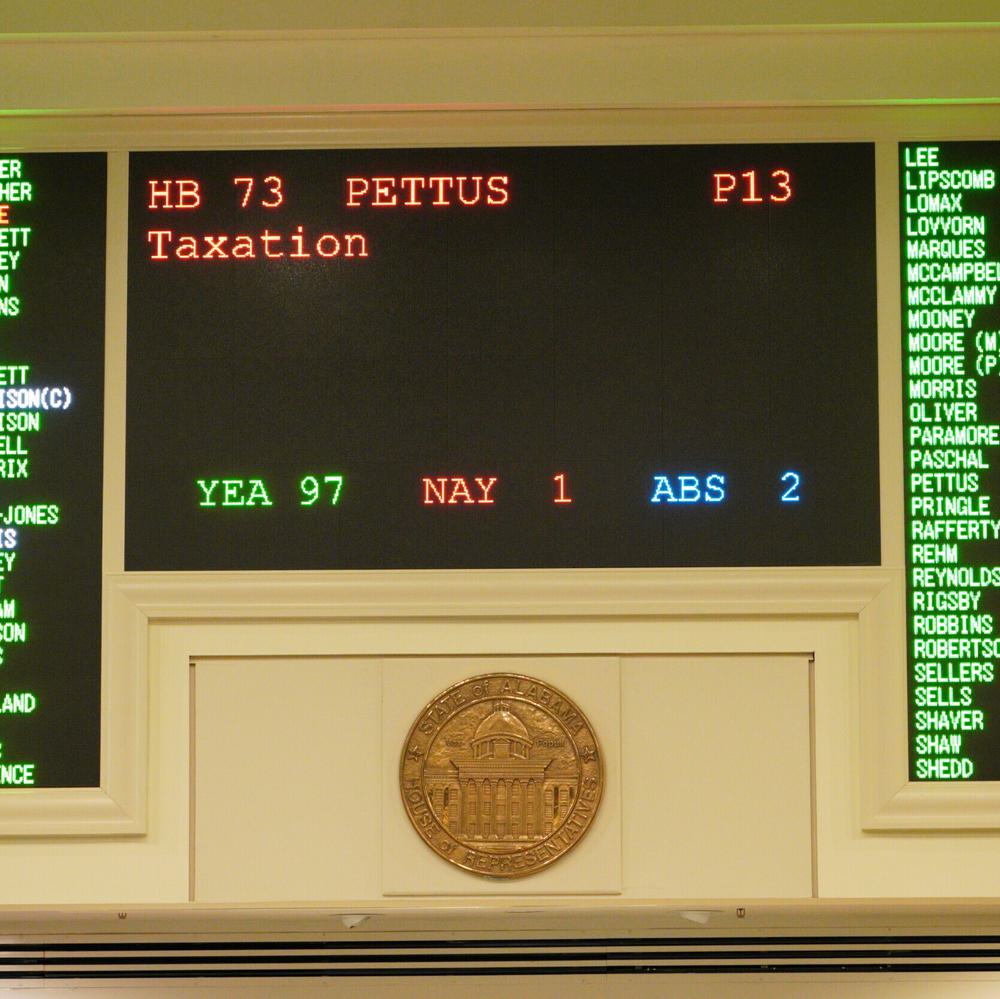

House Bill 73 (HB73) by State Rep. Phillip Pettus (R-Killen) would cap yearly property tax increases after a reappraisal.

Legislation that would cap the amount property taxes can increase year over year has passed the Alabama House of Representatives on Tuesday.

State Sen. David Sessions (R-Grand Bay) will file legislation in the upcoming legislative session capping how much property values can be increased on annual reappraisals.

State legislators have consistently insisted the state can't afford to permanently cut income taxes, much less eliminate them altogether. Lawmakers have also strayed away from reforming the state’s retirement system, even as it reported negative returns in 2022. One economist says they’re all wrong.

Tuscaloosa County residents voted no on a property tax increase on Tuesday that would have cost homeowners in the county an extra $8 per $1,000 of assessed property valuation a year.

Residents of Tuscaloosa County are voting in a referendum Tuesday to determine whether or not to increase property taxes for the county school system.

Residents of Tuscaloosa County will be voting in a referendum on Valentine’s Day 2023 to determine whether or not they will increase property taxes for the county school system.

Alabama is home to 565 public high schools, each ranging from under 400 students to almost 3,000.

Houston County Commissioners will consider passing a property tax increase at their next meeting on Monday at the request of the Houston County Healthcare Authority to benefit Southeast Health.

By Brandon Moseley There is a special election in St. Clair County Tuesday to consider raising property taxes for public schools. Two...