MONTGOMERY — The Alabama House of Representatives passed legislation on Tuesday that would cap the amount property taxes can increase year over year.

House Bill 73 (HB73) by State Rep. Phillip Pettus (R-Killen) would cap yearly property tax increases after a reappraisal. The legislation was amended several times on the House floor, bringing the final capped amount to 7%.

The bill initially capped residential property increase cap at 3% and commercial property at 5%. Pettus offered a floor amendment pushed by the League of Municipalities and county commissions. The amendment capped expenditures at 7% for both types of property.

Another amendment sunsets the legislation for three years, meaning the legislature will have to re-approve the bill after those three years.

The cap would not apply to properties that have undergone "significant improvements," including new construction, or to properties that have changed ownership.

State Rep. Jim Hill (R-Moody) offered two amendments to the bill. One would require increased taxes to go to the state and not local municipalities and counties, and the second would let local governments determine if the cap would go into effect if the county population rose by 1.5%. Both amendments failed.

State Rep. Brett Easterbrook (R-Fruitdale) opposed the percentage jumping to 7% and objected to the unfairness of property tax in general.

"One of my problems with the property tax is that in some of the faster-growing areas in my area, you have families that have a property that has been in that family for generations," Easterbrook said. "And now they can't afford to live there because the property taxes and insurance. They're having to move. There's nothing right about that," he said.

"I would love to see a bill to get rid of property tax completely. The only reason we have property tax is that was that was the only way they could collect taxes in the horse and buggy days because they couldn't find people. If you didn't pay your property tax, they sold the land. Property tax is the most unfair tax out there. You take a farmer trying to get by; he's paying for a dozen families' kids to go to school. A guy putting millions of dollars into a 401K or a stock investment is paying zero. There is nothing right about it. Just because you chose to invest in property versus other investments that you should pay for everybody else's children to go to school."

Pettus responded, saying he agreed with Easterbrook's sentiments but added, "You got to do what you got to do sometimes to get bills passed."

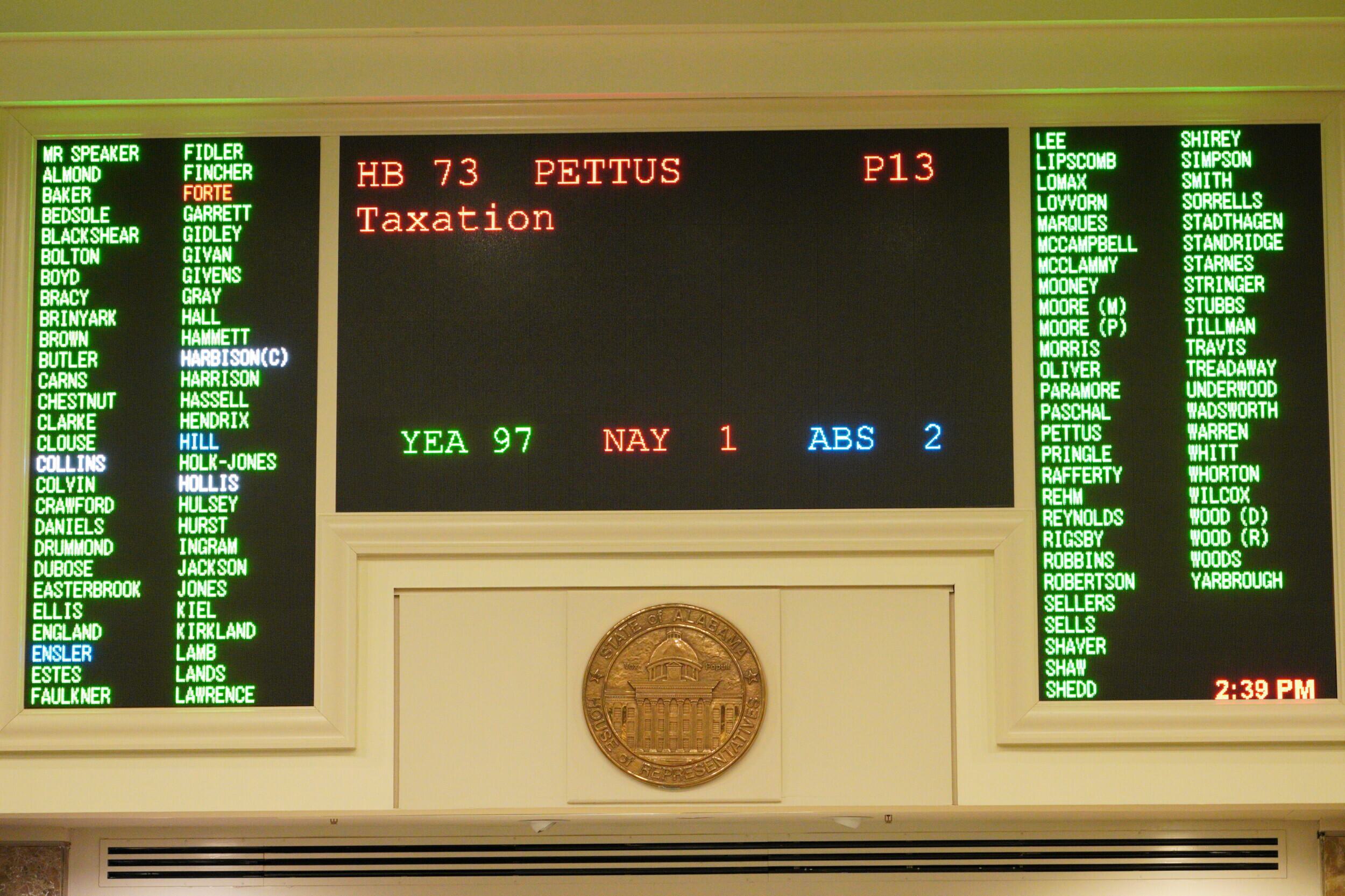

The bill ultimately passed the House with a vote of 97-1, with two abstentions. It will now go to the Senate for deliberation.

To connect with the author of this story or to comment, email craig.monger@1819news.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.