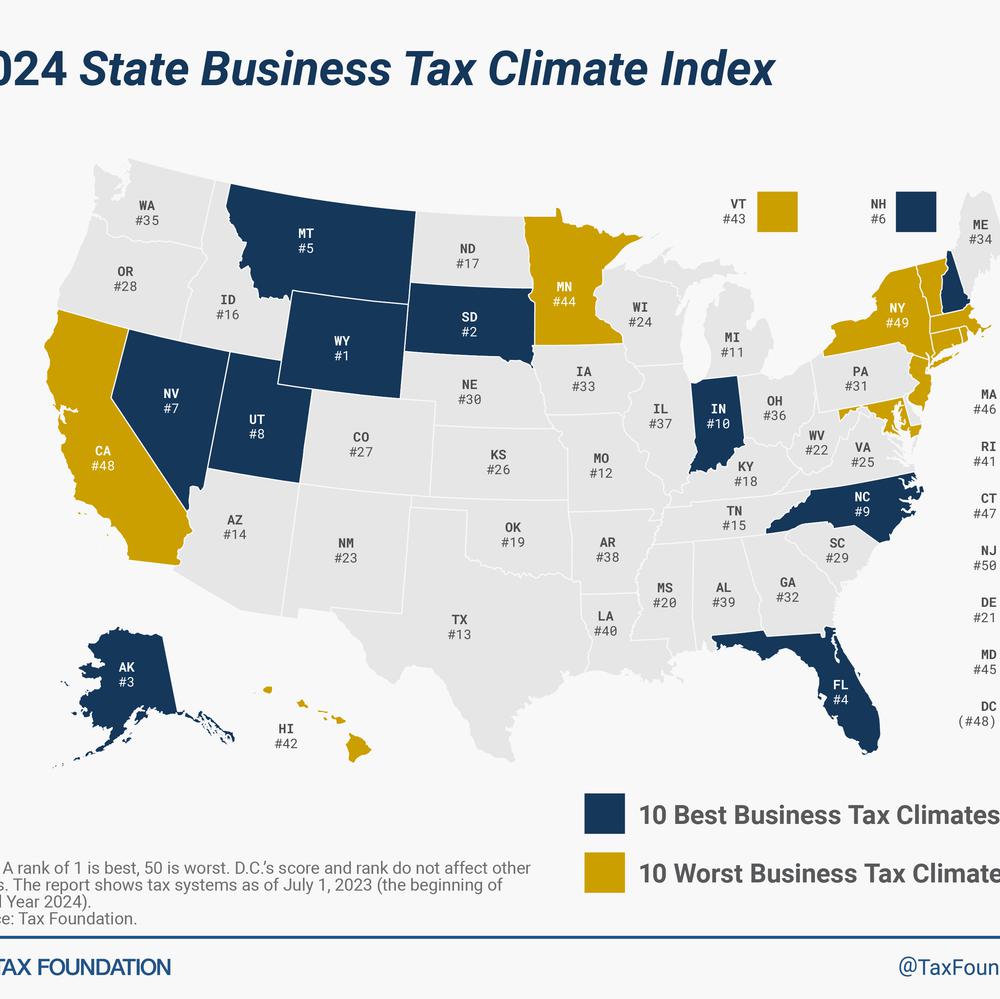

According to a new study released on Tuesday, Alabama ranks 39th in the nation for its business tax climate.

In the Tax Foundation's 2024 State Business Tax Climate Index, Alabama had the second-lowest score in the Southeast after Louisiana's ranking of 40th. The highest score went to Florida at 4th in the nation. The index ranked Alabama 41st overall last year.

The index scores states across five sub-indexes, each representing a major component of state tax codes: corporate taxes, individual income taxes, sales and excise taxes, property and wealth taxes, and unemployment insurance taxes.

Alabama received better-than-average rankings for its unemployment insurance tax (15th), property tax (17th), and corporate tax (19th). The Tax Foundation ranked Alabama 33rd for income taxes and last in the nation for its combined state and local sales taxes.

Alabama's state sales tax rate is the 40th-highest in the nation at 4%. However, the average sales tax rate levied by local governments is the highest in the nation at 5.25%.

The study's authors said the absence of a major tax is a common factor among many of the top 10 states.

"Unlike most studies of state taxes, it is focused on the how more than the how much, in recognition of the fact that there are better and worse ways to raise revenue," Jared Walczak, Tax Foundation vice president of State Projects, said in a post about the new study. "Inevitably, though, the publication of the Index raises some questions, like: if Wyoming and South Dakota lead in the rankings, why aren't more companies heading for the Black Hills? Tax competition is a little like WAR—not conflict, but Wins Above Replacement. The term comes from baseball, where it is intended as a sabermetric statistic to measure how many more wins a team can claim due to a specific player above the amount that would be generated by a replacement-level player. It's much the same way in public finance: a well-structured tax code won't make the Wyoming Basin a metropolis, nor will poor tax structure make Manhattan a ghost town. But tax structure does play a role in a state's economic successes or failures, and often a substantial one. Every state can benefit from a simple, neutral, transparent, pro-growth tax structure."

To connect with the author of this story or to comment, email caleb.taylor@1819News.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.