By Brandon Moseley

Food prices are climbing, directly impacting Alabama families – particularly the poor and those on fixed incomes. Two legislators on Thursday told 1819 News that they are introducing legislation to help those families by repealing the state’s 4% tax on groceries.

State Rep. Mike Holmes (R-Wetumpka) told 1819 News that he has taken two bills that were previously introduced in past sessions and is combining elements of both in a new bill that he plans to pre-file ahead of the 2022 Alabama regular session.

State Rep. Patrice “Penni” McClammy (D-Montgomery) told 1819 News, “I am pre-filing a bill,” to repeal the food tax. “That is one of the first things I intend to do.”

McClammy is the daughter of the late Rep. Thad McClammy (D-Montgomery) who died earlier this year. Penni won her father’s seat in the special election that followed.

Holmes said of McClammy, “Her father fought that battle for years," referring to repealing the tax on food.

State Rep. Charlotte Meadows (R-Montgomery) said she supported a similar bill by former State Rep. John Knight (D-Montgomery).

The state is received a record amount of revenue in 2021 and the 2022 budgets are bigger than the 2021 budgets. The legislature is already talking about supplemental appropriations for 2022, as revenues are greater than projections thus far.

“If not now then when?” Meadows said. “Yes, there could be problems further down the line, but there will never be a better time to do it than now.”

State Sen. Tom Whatley (R-Auburn) told 1819 News, “It has been discussed for years.”

1819 News asked Whatley why it has never passed.

“I am not sure,” Whatley said. “You should ask the budget chairs. They work closer on that.”

State Sen. Jim McClendon (R-Springville) told 1819 News that he believes since 2022 is an election year, he thinks legislators could finally repeal the state’s grocery tax.

“There is nothing more conservative to tell voters than cutting taxes,” McClendon said.

Holmes said that he has studied previous bills and identified issues that came up with them and his bill addresses those issues.

“They did not define food,” Holmes said.

Holmes said his bill will use the federal definition rather than attempting to write a special state definition.

McClendon said that the state legislature would only address the state taxes on food. The legislature cannot remove county and city sales taxes on groceries.

Many citizens in Alabama pay seven, eight, even ten percent tax on all of their food. Four percent of that is state sales tax. The rest is county, city, and/or school district taxes.

Some legislators are concerned about how to replace grocery tax revenue, which goes to both the education and general fund budgets.

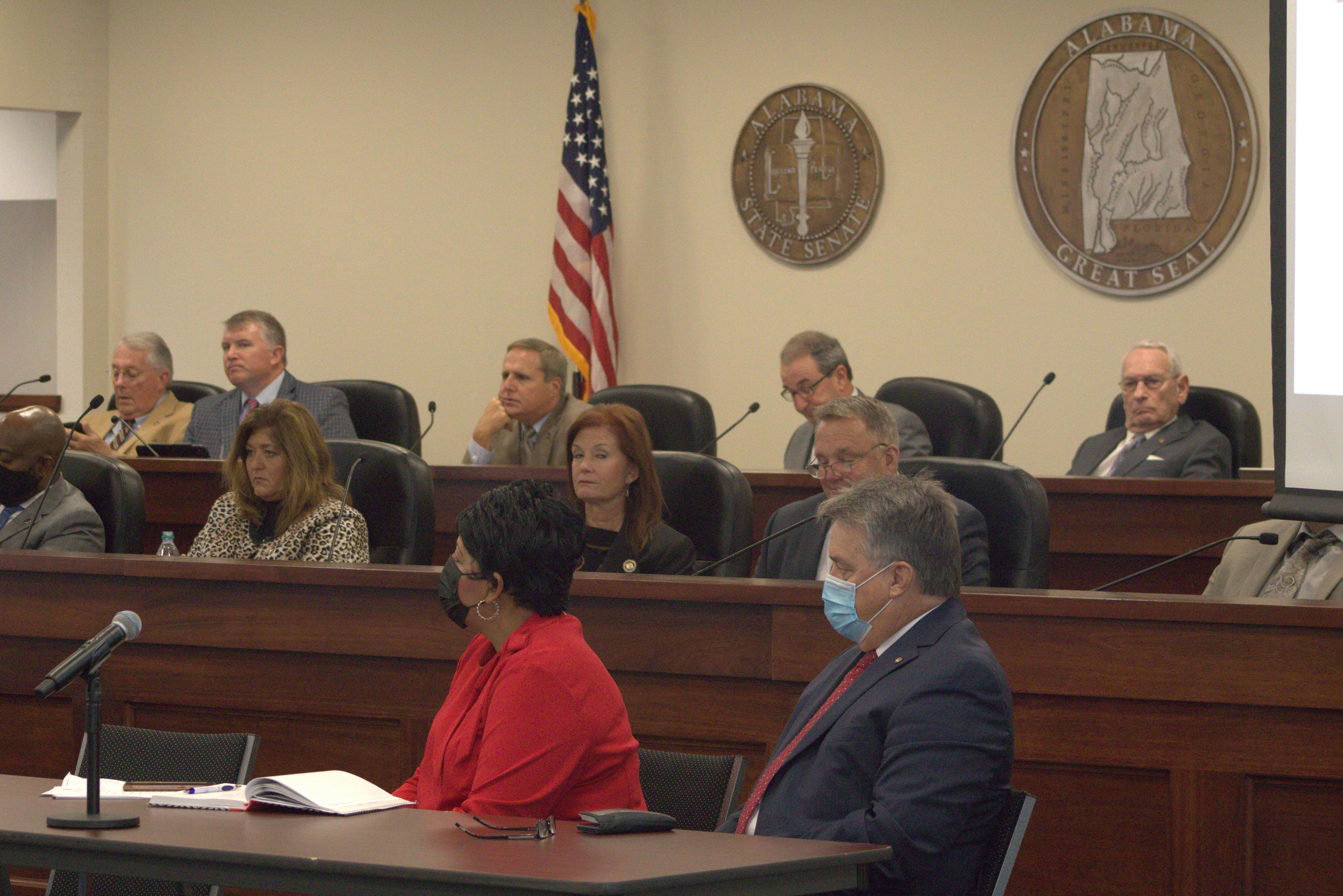

On Thursday, the joint House and Senate budget committees met in Montgomery for a briefing on the billions in federal funds that the state has received from both the American Rescue Act and the Infrastructure Investment and Jobs Act

State Rep. Steve Clouse (R-Ozark), who chairs the state House Ways & Means General Fund committee, announced that the legislature will hold joint budget committee meetings on the morning of the first day of the 2022 regular legislative session, which will be Jan. 11. Those meetings will be followed by hearings on Jan. 12.

1819 News will have more details about the bills to eliminate the state sales tax on food after those bills are pre-filed in the coming weeks.