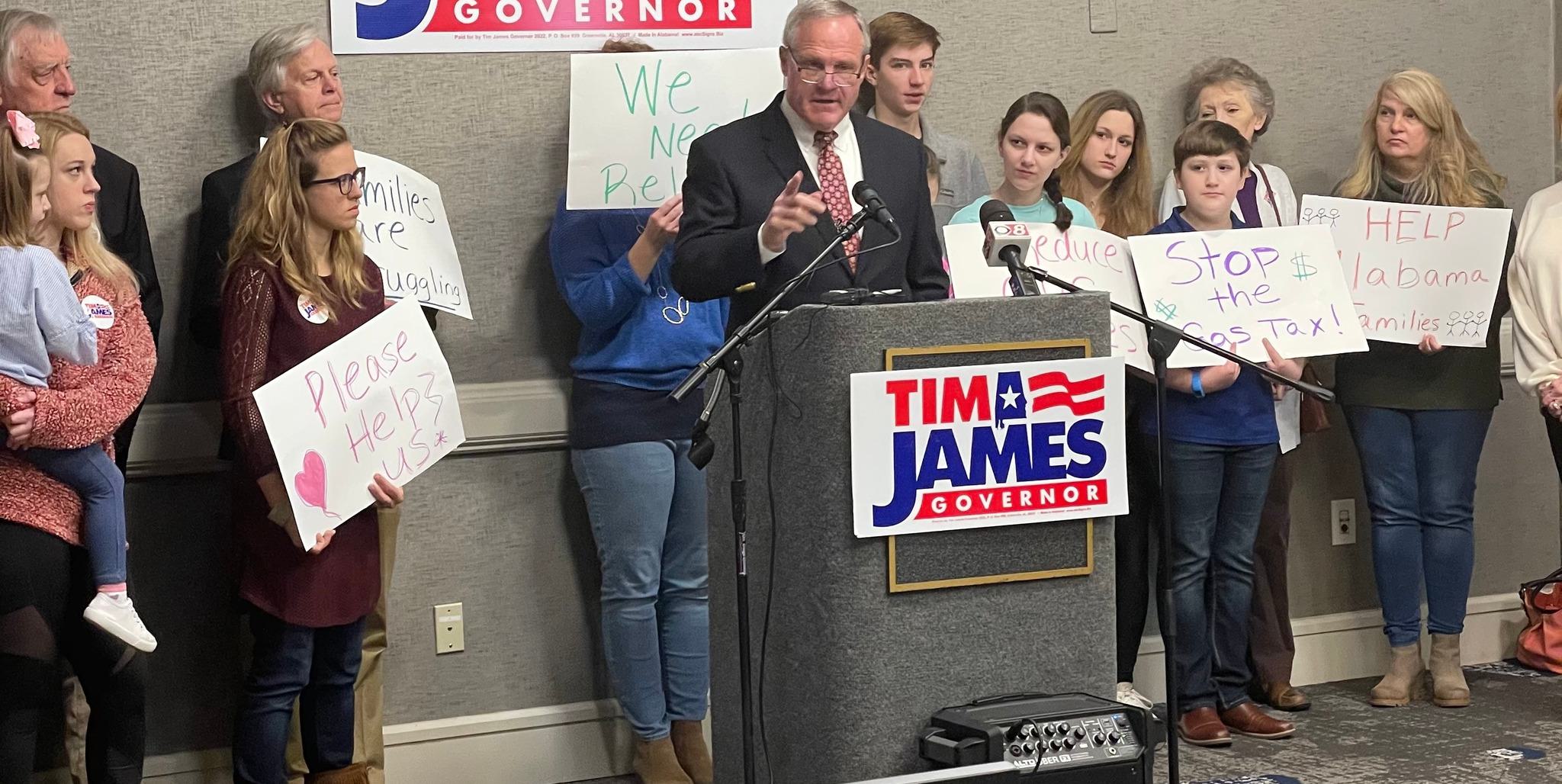

Greenville businessman and Republican gubernatorial candidate Tim James promised that eliminating the 4% tax on groceries would be part of his legislative agenda if elected. James made the announcement at a press conference in Montgomery on Wednesday.

“I would immediately move to repeal the state’s grocery tax,” James said. “With the prices of food gone crazy, this is yet another way that we can alleviate the financial pain for families fighting to make ends meet and put another $500 million back into our economy.”

Many groups have advocated for the repeal of the 4% tax on food in the state.

Alabama Arise recently had a rally at the State House asking legislators to repeal the tax on groceries.

Alabama Arise said on its website that Alabama, “Is one of only three states with no tax break on groceries. The state grocery tax is 4%, equal to two weeks’ worth of groceries each year. Alabama can and should untax groceries quickly and responsibly.”

The Alabama Policy Institute is also in favor of ending the state tax on food.

“Groceries are exempt from state sales taxes in most of the country, with only 13 states taxing groceries at all,” API President & CEO Caleb Crosby said in a statement. “Out of the 13 states that do tax groceries, only Alabama, Mississippi, and South Dakota tax them at the full amount without any credit or rebate.”

Alabama Arise favors legislation by State Sen. Andrew Jones (R-Centre) and State Rep. Mike Holmes (R-Wetumpka) that would replace the lost revenue by capping the federal income tax deduction.

Alabama Arise explained, “A pair of companion bills would untax groceries and protect education funding by capping the FIT deduction. Jones’ SB 43 and Holmes’ HB 173 both would end the state grocery tax and cap the FIT deduction for individuals. The cap for Alabamians who file as single, head of household or married filing separately would be $4,000 annually. For married couples filing jointly, the FIT deduction limit would be $8,000 a year. The plan would require voter approval of a constitutional amendment.”

The API position is that the money does not need to be replaced.

“With state budgets hitting record high after record high, it is past time for Alabama to end this tax,” Crosby said. “The fact is that Montgomery is flush with cash. State leaders need not pretend that the sales tax on our bread and milk is essential.”

James also argued that replacing the lost revenue to the Education Trust Fund (ETF) budget is unnecessary, citing the $1.2 billion surplus in the ETF which is being spent on a FY2022 supplemental appropriation.

“The lovers of big government are going to begin asking how I plan to pay for these millions of dollars in tax breaks,” James said. “I would use the full $1.5 billion surplus without the carryover as a start to pay for these moves in just this year. Then in looking at the projected revenue growth over the next two fiscal years, if we simply held spending flat, we could absorb the permanent elimination on the grocery taxes and the business privilege taxes.”

James went further and listed more taxes he would cut including the business privilege tax, fuel taxes, and some occupational license fees.

“As governor, I would direct all agencies to implement zero-based budgeting, which means that each agency would have to justify every penny they are spending, and I would work with the legislature to sweat out savings across the board,” James said.

James said that he is, “Running for governor because our nation is at a tipping point. We will either go the way of Marxism where government controls everything under a yoke of fear and intimidation, or we will turn back to one nation under God where freedom rings.”

Lindy Blanchard, Lew Burdette, Stacy Lee George, Kay Ivey, Tim James, Donald Trent Jones, Dean Odle, Dave Thomas, and Dean Young are all running in the Alabama Republican Primary on May 24.

To connect with the author of this story, or to comment, email brandon.moseley@1819News.com.