An Alabama economist weighed in on last week’s Silicon Valley Bank and Signature Bank collapse, explaining that the central banking system is the “leading problem” of the country’s financial situation and warning President Joe Biden’s assurance of the banking system’s safety “could backfire.”

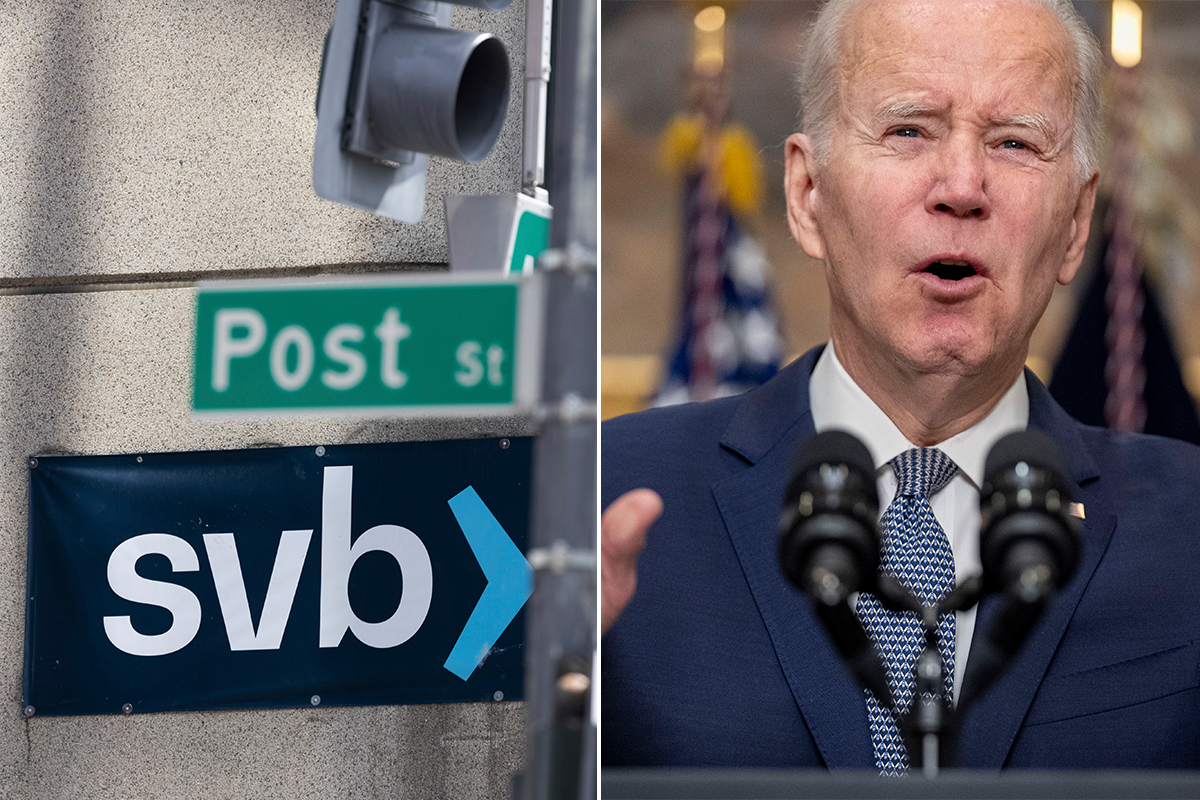

The California-based Silicon Valley Bank and New York-based Signature Bank collapsed last week after facing bank runs. A bank run is when multiple clients withdraw their money from a bank all at once in fear of losing their money. Since banks lend out more money than they have in deposits, the bank’s reserve is in jeopardy, causing a collapse.

The two banks are now under the control of federal regulators.

Troy University’s Johnson Center for Political Economy executive director Allen Mendenhall told 1819 News that it’s too early to call the recent bank runs a crisis. However, the cause for the situation traces back to the Federal Reserve, the country’s central banking system created by President Woodrow Wilson in 1913.

“Do we start with the Federal Reserve’s recent interest rate hikes?” Mendenhall asked. “Or do we go back to when the Federal Reserve lowered interest rates to stimulate spending during the pandemic? That resulted in the inflationary pressures that later forced the Federal Reserve to reverse policy and raise interest rates. There’s not just one cause here, but the Fed is clearly the leading problem. We will always have dangerous fluctuations when the economy is dependent upon the machinations of our central bank.”

On Monday, Biden said the country’s banking system is secure, and taxpayers wouldn’t be responsible for bailing out the investors at the two banks, but bank customers would have access to their deposits. According to Biden, customers will receive their deposits from a U.S.-government-held account intended for emergencies of this kind.

Mendenhall said the president’s assurance could backfire and pointed out that the president doesn’t have a good track record of being honest with the American people.

“His approval ratings are low, public trust in government is at historic lows, and inflation occurred under his leadership,” Mendenhall said. “He supported Fauci’s misrepresentations and errors. He’s stating falsehoods such as the average tax for billionaires is lower than that of schoolteachers or firefighters.”

“Having damaged his credibility, people may rush to their banks to withdraw cash — precisely the situation he and his administration hope to avoid,” Mendenhall continued. “He should have chosen someone in his administration with more credibility to deliver his message. The problem is, who would that be?”

To connect with the author of this story or to comment, email will.blakely@1819news.com or find him on Twitter and Facebook.

Don’t miss out! Subscribe to our newsletter and get our top stories every weekday morning.