By Craig Monger

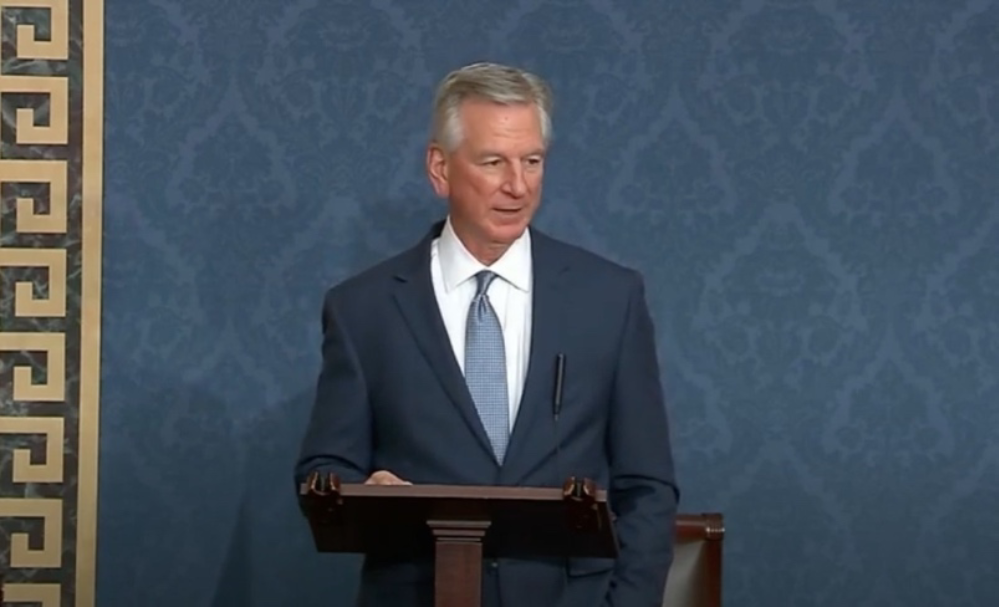

U.S. Senator Tommy Tuberville (R-Alabama) has responded to Business Insider’s “danger” designation due to late disclosed stock transactions.

Tuberville received backlash in July when it was revealed that he had failed to report the buying and selling of stocks. Due to federal legislation, all members of public office must disclose stock transactions within an appointed time to prevent ethical breaches in trading.

Business insider recently gave Tuberville a “danger" rating, saying that “[the] member has multiple issues that could expose them to ethical problems.” The report from Business Insider claimed that Tuberville had failed to disclose 134 transactions within the 45 days allotted for politicians to disclose stock trades.

Tuberville responded to the rating by Business Insider, chalking up the error to a misinterpretation of a rule while serving his first quarter in office.

“That happened my first quarter that I was here, a misinterpretation of a rule,” Tuberville said. “We abided by all the rules. We were a few days late. And now that my office understands the rules, we have two or three people in charge of it. We have not had any problems since, and we won’t have any problems since. Everything’s above board, straight out there; we get it in on time.”

According to the disclosure released by Tuberville, he had 93 stock transactions in the first quarter of 2021. Meaning, when he filed the disclosure on July 7, he was well past the 45-day deadline for at least 93 of his transactions.

The Stop Trading on Congressional Knowledge Act (STOCK Act) was created in 2012 to prohibit Members of Congress and employees of Congress from using nonpublic information derived from their official positions for personal benefit.

According to a report from Forbes, Tuberville had bought and sold stocks from several companies with which he would have intimate knowledge due to his position as a senator.

The report states that, while a member of the Armed Services Committee, Tuberville made four separate purchases of Alcoa, a defense contractor, totaling more than $80,000, before liquidating his entire holding in April.

The penalty for a first-time violation of the STOCK act is $200, and a spokesman for Tuberville said that he had paid all outstanding fines.

To connect with the author of this story, or to comment, email Craig.Monger@1819News.com.