MONTGOMERY — Alabama House Democrats called for a repeal of the state's sales tax on groceries on Monday.

Alabama is one of just a few states that taxes groceries at the full state sales tax rate. According to the Tax Foundation, Alabama has the fourth-highest state and local combined average sales tax rate. Alabama's state sales tax rate is 4%.

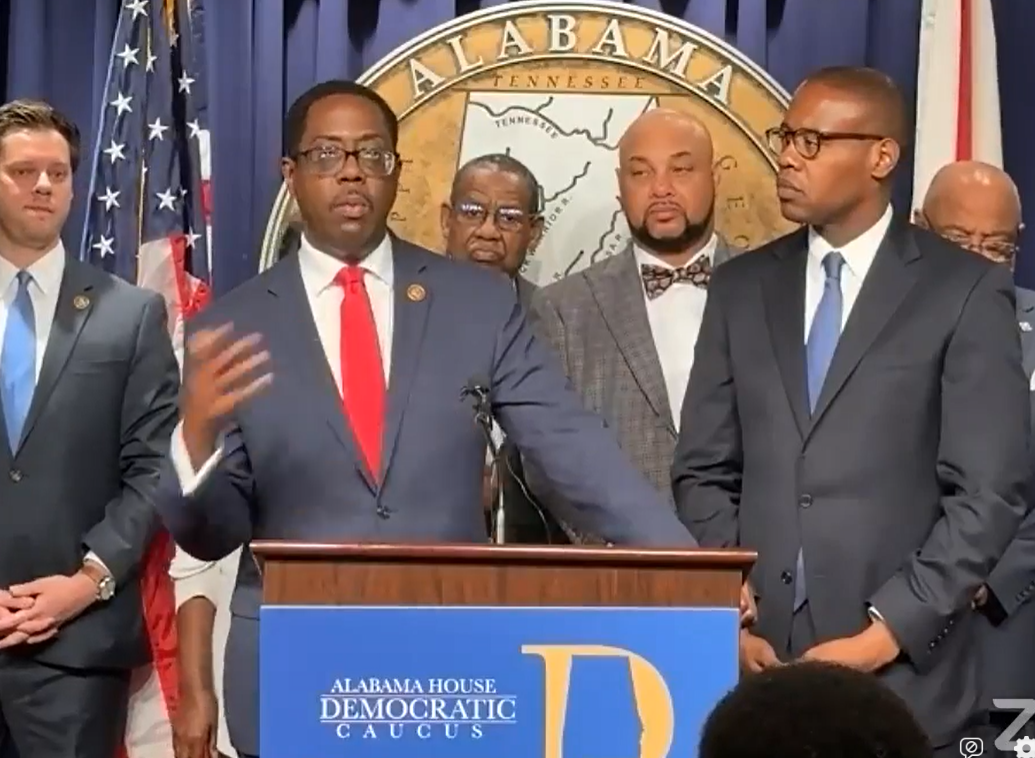

State Rep. Prince Chestnut (D-Selma) said at a press conference on Monday that "it is time to end regressive taxes such as the grocery tax and the state income tax on overtime pay."

"It's a very regressive tax, and as a result of it, you're punishing the poor, the poorest among us," Chestnut added.

State revenue wouldn't decline too much with a repeal of the state sales tax on groceries because consumers would spend the savings on other items, according to House Minority Leader Anthony Daniels (D-Huntsville).

"Eggs were two dollars a couple of years ago," Daniels said at the press conference. "They're probably eight dollars now. So at two dollars, you were paying in some places (with a 10 percent state and local combined sales tax)... that's twenty cents that you're recouping for the Education Trust Fund. Now you're recouping 80 cents for the same item, so there's four times the amount that you're receiving from a tax revenue standpoint. That's why the budgets are where they are. You're seeing an increase."

Alabama's state government has had sizeable budget surpluses in the last couple of fiscal years.

"Those individuals that think this is too much of a hit on the front end, then let's do a payroll tax month to test it," Daniels said. "June of 2023, do a month-long (test) of no tax on groceries. Once the receipts come in for the growth in the Education Trust Fund, you compare it to the previous year, and then it will tell us if whether or not what we're saying is accurate. I don't believe there's going to be a hit because they're going to spend money in other areas."

State Rep. Mary Moore (D-Birmingham) said she's suggested in the last couple of years to cut the state sales tax on groceries incrementally as the state's gas tax increased.

"They don't even allow it to go in committee for us to have discussion about it," Moore said. "If we could ever talk about it, maybe we could brainstorm and come up with even other ways that you could do it. When you are not interested in relieving the hardship of the poorest people in your state, you will always say that you don't know how to do it, but there are those of us that are willing to discuss it."

Alabama's legislative session begins on Tuesday.

To connect with the author of this story or to comment, email caleb.taylor@1819News.com.

Don't miss out! Subscribe to our newsletter and get our top stories every weekday morning.