Account

Loading...

Alabama and 10 other states sued three major asset managers on Wednesday in federal court for “conspiring to artificially constrict the market for coal.”

Alabama agriculture can’t afford ESG mandates. We need Alabama elected officials at all levels of government to fight back on these ESG proposals.

The environmental, social governance (ESG) movement is an effort to take control of companies and change policy through access to capital, according to Alabama Attorney General Steve Marshall.

Alabama agriculture commissioner Rick Pate is one of 12 commissioners nationwide signing onto a letter demanding six of the largest banks in the nation stop participating in woke agendas.

An Alabama lawyer and economist said that a recent lawsuit from the state of Tennessee against the financial titan BlackRock, Inc. over its environmental, social, governance (ESG) investment strategy could shed light on the massive asset management corporation.

Economic expert Andrew Puzder warned on Tuesday during a speech at Troy University of the perils environmental, social, and governance investing might have on the average American.

After 1819 News reported on a “spotlight bias” study from the 1792 Exchange, which gave the Retirement Systems of Alabama’s investment managers one of the highest “Pro-ESG” averages in the country, a spokesperson from RSA responded to refute the nonprofit’s claim.

The 1792 Exchange released a new “spotlight bias report” detailing the percentage of “pro-ESG” resolutions supported by state pension funds in 2022, and the Retirement Systems of Alabama (RSA) landed near the top of the list.

Last spring, the Alabama Legislature passed what some Republicans called the strongest piece of legislation battling controversial environmental, social, governance investing in the country. Gov. Kay Ivey signed the bill into law in June.

The Birmingham City Council unanimously voted to enter a $4.5 million funding agreement on Tuesday with PNC Bank to provide for improvements to the historic baseball stadium Rickwood Field.

A poll released this summer by the Center for Excellence in Polling (CEP) showed a majority of Alabamians oppose investing taxpayer money in companies that use ideology as a metric to make business and investment decisions.

One of the largest credit rating agencies in the nation announced last week they were going to stop publishing the environmental, social and governance scores of corporate borrowers.

Last week, Politico released an article suggesting progressives in the Democratic Party are the true allies of the free market economy because of their support of environmental, social governance investing and large asset managers like BlackRock Inc. and Vanguard.

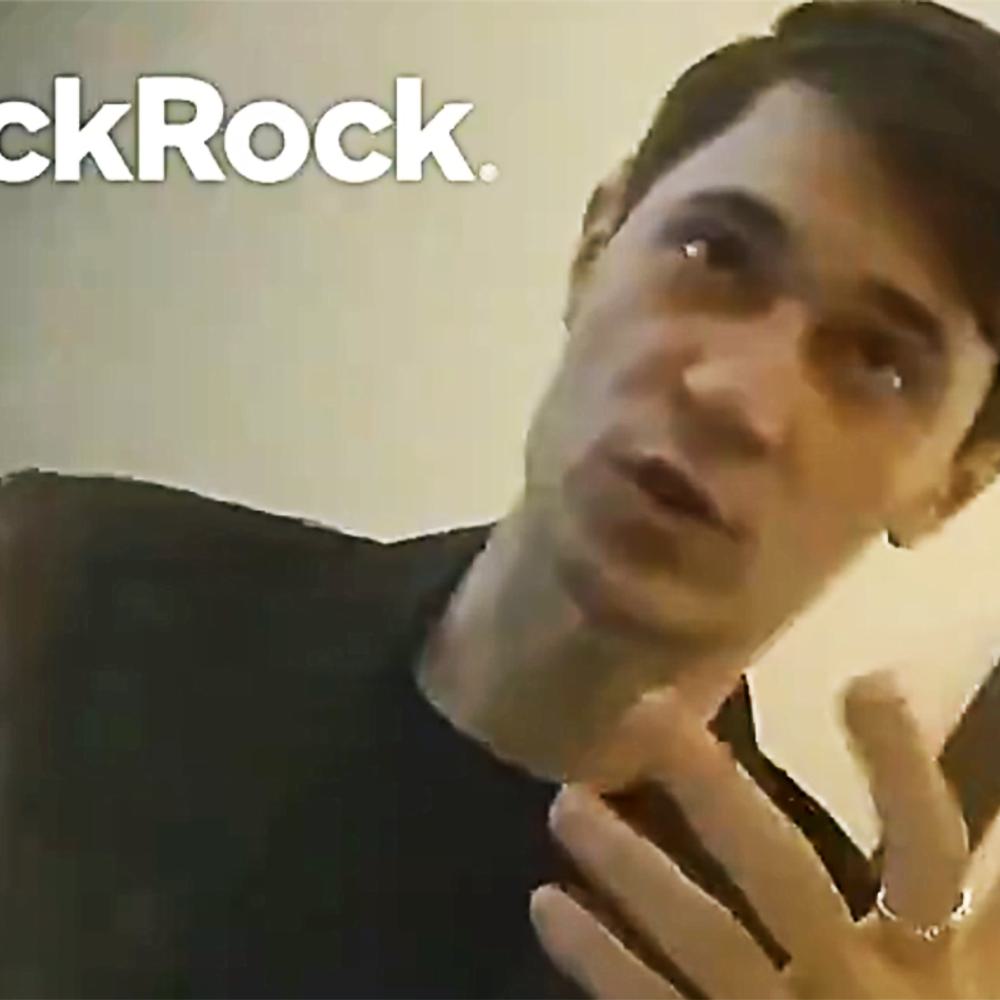

Independent journalist James O’Keefe released a video on Wednesday morning in which an alleged BlackRock Inc. employee suggested the company is purchasing politicians and profiting off of war. One Alabama lawyer, economist and think-tank leader said it’s a sign that the company has “an uncanny and nefarious ability to influence politicians.”

Earlier this month, Alabama Gov. Kay Ivey signed into law restrictions on financial institutions’ ability to use environmental, social governance (ESG) factors to discriminate in business decisions while entering contracts with the state.

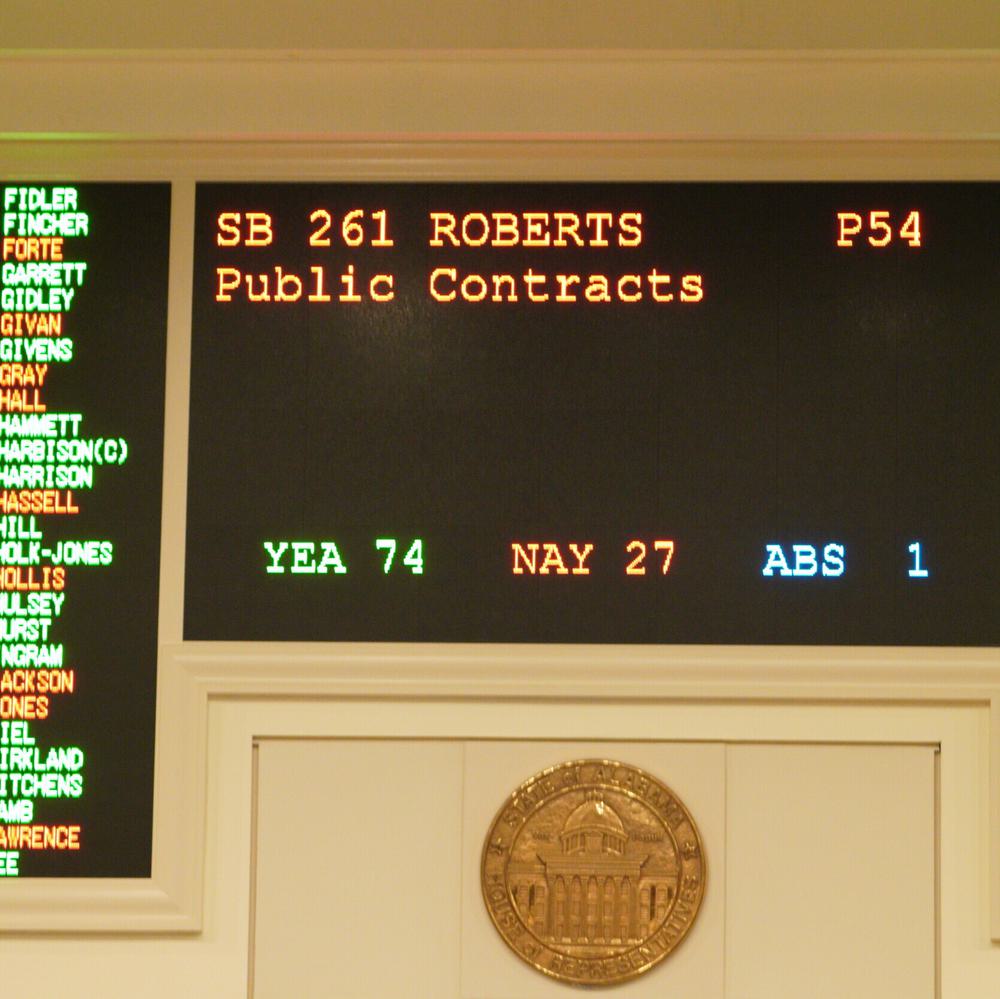

Legislation by State Sen. Dan Roberts (R-Mountain Brook) prohibiting state contracts with businesses that boycott specific sectors of the economy based on environmental, social and governance was signed into law by Gov. Kay Ivey on Tuesday.

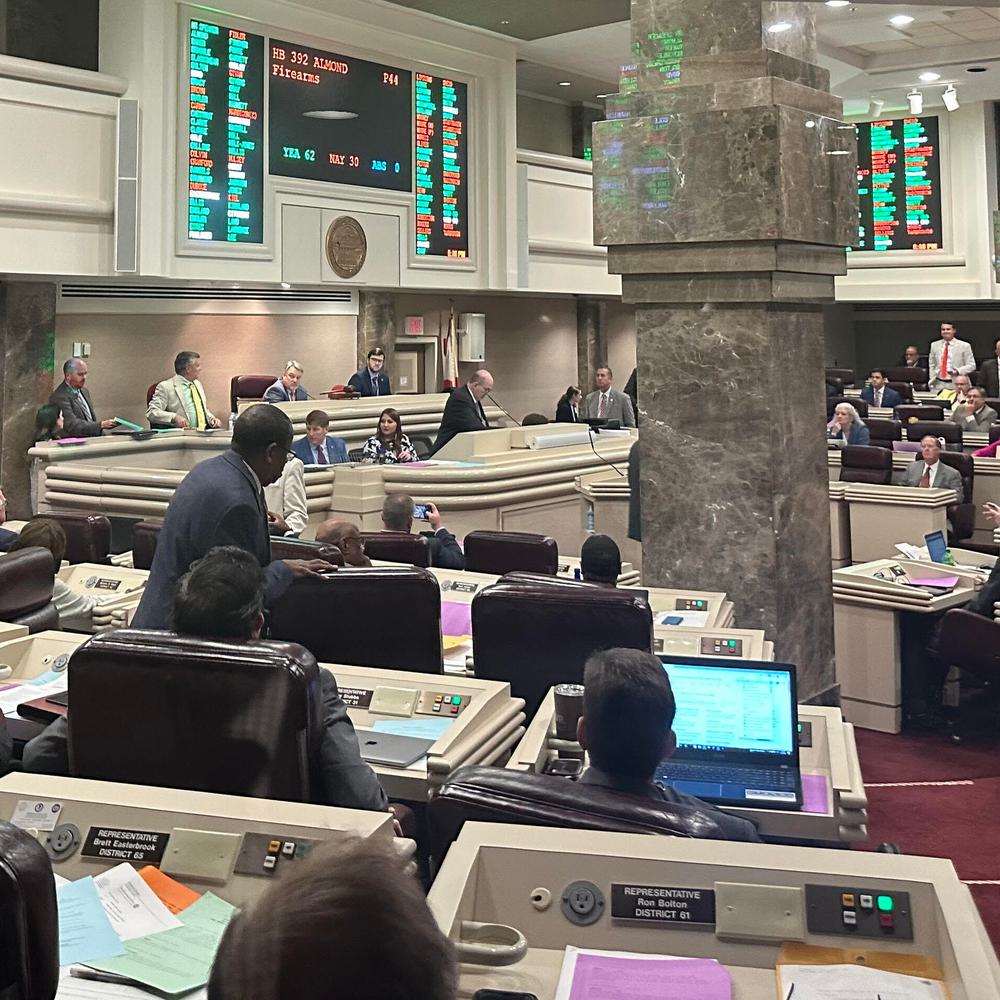

Legislation by State Sen. Dan Roberts (R-Mountain Brook) prohibiting state contracts with businesses that boycott specific sectors of the economy based on environmental, social and governance policies passed the Alabama House of Representatives unamended and with no debate.

Legislation by State Sen. Dan Roberts (R-Mountain Brook) prohibiting state contracts with businesses that boycott certain sectors of the economy based on environmental, social and governance (ESG) policies is on the docket for a House vote on Wednesday.

With only three legislative days remaining, one of the bills remaining on the docket is sponsored by State Sen. Dan Roberts (R-Mountain Brook) that would prohibit state contracts with businesses that boycott certain sectors of the economy based on environmental, social and governance (ESG) policies.

Vanguard and BlackRock Inc., two large asset management companies committed to controversial so-called “sustainable” investing, happen to be the largest owners of Birmingham-based Regions Financial.

Legislation by State Sen. Dan Roberts (R-Mountain Brook) prohibiting state contracts with businesses that boycott certain sectors of the economy based on environmental, social and governance (ESG) policies passed the House Financial Services Committee on Wednesday.

Alabama Attorney General Steve Marshall published an op-ed in the Wall Street Journal on Tuesday criticizing ESG agenda proponents who purport to be defenders of the free market.

In a recent interview with 1819 News, Alabama AG Steve Marshall said he supported State Rep. Dan Roberts’ anti-ESG bill and was “appreciative” that Roberts was addressing the issue for the state while Marshall focuses on the national level.

Though Alabama’s “big mules” have changed over the last century, they still hold outsized influence over who's doing the pulling and who’s doing the eating in the Heart of Dixie.

Last week, State Sen. Dan Roberts' (R-Mountain Brook) bill that would prohibit state contracts with businesses that boycott certain sectors of the economy based on environmental, social and governance (ESG) policies passed out of the Fiscal Responsibility and Economic Development Committee.

Can a law restricting banks increase economic freedom? In the case of Alabama’s Senate Bill 261, the “anti-ESG” bill, the answer is likely yes.

The Alabama Senate approved a $1 million appropriation for Troy University’s Johnson Center for Political Economy last week in its Education Trust Fund budget, but Johnson Center executive director Allen Mendenhall said he only found out about this when a reporter showed him the bill.